You should attempt to answer this question yourself before looking up the suggested answer, which appears on

Question:

You should attempt to answer this question yourself before looking up the suggested answer, which appears on page 842. If any part of your answer is incorrect, check back carefully to make sure you understand where you went wrong.

(a) Polimur Ltd operates a process that produces three joint products, all in an unrefined condition. The operating results of this process for October 1979 are shown below.

Output from process:

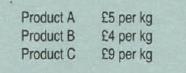

Product A 100tonnes Product 8 80tonnes Product C 80tonnes The month's operating costs were £1300000. The closing stocks were 20 tonnes of A, 15 tonnes of 8 and 5 tonnes of C. The value of the closing stock is calculated by apportioning costs according to weight of output. There were no opening stocks and the balance of the output was sold to a refining company at the following prices

Required:

Prepare an operating statement showing the relevant trading results for October 1979. (6 marks)

(b) The management of Polimur Ltd have been considering a proposal to establish their own refining operations.

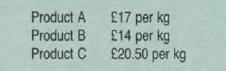

The current market prices of the refined products are:

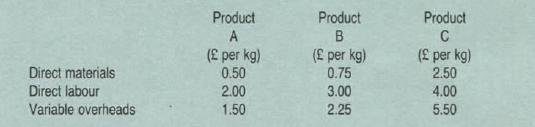

The estimated unit costs of the refining operation are:

Prime costs would be variable. Fixed overheads, which would be £700000 monthly, would be direct to the refining operation. Special equipment is required for refining product B, and this would be rented at a cost, not included in the above figures, of £360 000 per month.

It may be assumed that there would be no weight loss in the refining process and that the quantity refined each month would be similar to October's output shown in

(a) above.

Required:

Prepare a statement that will assist management to evaluate the proposal to commence refining operations. Include any further comments or observations you consider relevant

Step by Step Answer: