Question:

1. Based on ZYSCO€™s BSC and strategy map, create a BSC for either the finance or sales departments.

2. What problems might arise with ZYSCO seeking to link its compensation system with its new system and measures?

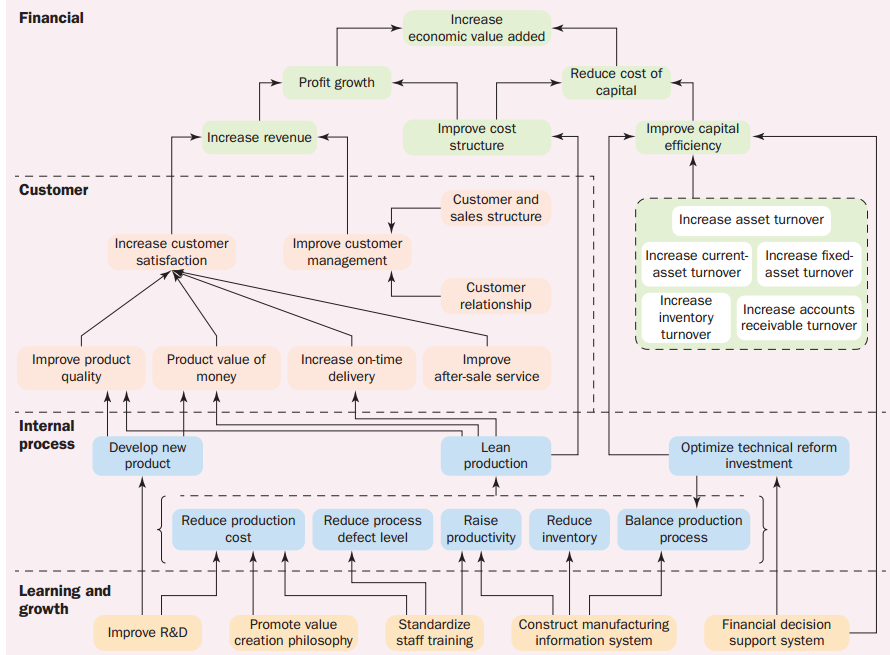

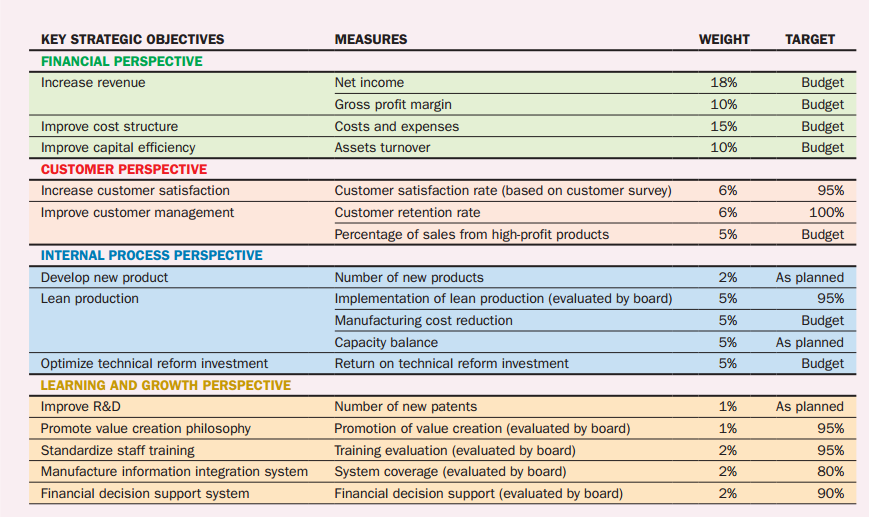

An article by Chen et al. (2015) published in Strategic Finance described how Zhongyuan Special Steel Co. (ZYSCO), a typical Chinese state-owned company, introduced a new strategic management system that would integrate its value creation strategy into everyone€™s day-to-day job. The BSC was the core of this new system. The foundation for implementing a balanced scorecard (BSC) was ZYSCO€™s strategy map. The BSC task force first drew the strategy map shown in Figure 1. Next, the BSC was developed based on ZYSCO€™s strategy map. Figure 2 shows the BSC and indicates how the strategic objectives were translated into performance measures.

Since the steel industry in China had large over-capacity problems, the company downplayed revenue growth and production capacity as financial measures and focused on increasing net income by controlling costs and expenses. For the customer perspective, customer satisfaction rate is based on a customer survey, which includes evaluation of product quality, on-time delivery, after-sale service and so on.

ZYSCO€™s BSC was then decomposed by departments creating BSCs using the company€™s strategy map and BSC as a guide. The authors concluded that ZYSCO€™s compensation system should be linked to the new system and new measures.

Figure 1

Figure 2

Transcribed Image Text:

Financial Increase economic value added Reduce cost of capital Profit growth Improve capital Improve cost Increase revenue efficiency structure Customer Customer and sales structure Increase asset turnover Improve customer management Increase customer I Increase current- Increase fixed- i satisfaction asset turnover asset turnover Customer Increase relationship Increase accounts receivable turnover inventory turnover Product value of Improve product quality Increase on-time Improve after-sale service delivery money Internal process Optimize technical reform investment Develop new product Lean production Reduce production Reduce process Raise Reduce Balance production defect level productivity inventory cost process Learning and growth Construct manufacturing information system Standardize staff training Promote value Financial decision Improve R&D creation philosophy support system KEY STRATEGIC OBJECTIVES MEASURES WEIGHT TARGET FINANCIAL PERSPECTIVE Increase revenue Net income 18% Budget Gross profit margin 10% Budget Improve cost structure Costs and expenses 15% Budget Improve capital efficiency Assets turnover 10% Budget CUSTOMER PERSPECTIVE Increase customer satisfaction Customer satisfaction rate (based on customer survey) 6% 95% Improve customer management Customer retention rate 6% 100% Percentage of sales from high-profit products 5% Budget INTERNAL PROCESS PERSPECTIVE Develop new product Number of new products 2% As planned Lean production Implementation of lean production (evaluated by board) 5% 95% Manufacturing cost reduction 5% Budget Capacity balance 5% As planned Optimize technical reform investment Return on technical reform investment 5% Budget LEARNING AND GROWTH PERSPECTIVE Improve R&D Number of new patents 1% As planned Promote value creation philosophy Promotion of value creation (evaluated by board) 1% 95% Standardize staff training Training evaluation (evaluated by board) 2% 95% Manufacture information integration system System coverage (evaluated by board) 2% 80% Financial decision support system Financial decision support (evaluated by board) 2% 90%