GF is a company that manufactures clothes for the fashion industry.The fashion industry is fast moving and

Question:

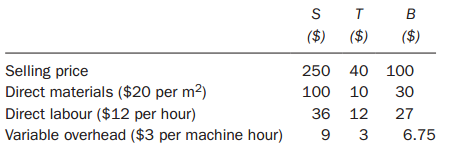

GF is a company that manufactures clothes for the fashion industry.The fashion industry is fast moving and consumer demand can change quickly due to the emergence of new trends.GF manufactures three items of clothing: the S, the T and the B using the same resources but in different amounts.Budget information per unit is as follows:

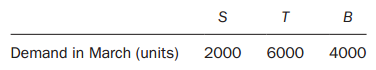

Total fixed costs are $300 000 per month. Included in the original budget constructed at the start of the year, was the sales demand for the month of March as shown below:

After the original budget had been constructed, items of clothing S, T and B have featured in a fashion magazine. As a result of this, a new customer (a fashion retailer), has ordered 1000 units each of S, T and B for delivery in March. The budgeted demand shown above does not include this order from the new customer. In March there will be limited resources available. Resources will be limited to:

Direct materials .................14 500 m2Direct labour ......................30 000 hours

There will be no opening inventory of material, work in progress or finished goods in March.

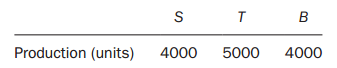

Required:(a) Produce a statement that shows the optimal production plan and the resulting profit or loss for March. You should assume that the new customer?s order must be supplied in full.(b) Explain TWO issues that should be considered before the production plan that you produced in part (a) is implemented. The Board of Directors have now addressed the shortage of key resources at GF to ensure that production will meet demand in April. The production plan for the month of April is shown below:

(c) For April,(i) Calculate the break even sales revenue for the given product mix in the production plan.(ii) Calculate the margin of safety percentage.(iii) Explain THREE limitations of breakeven analysis for GF.

(c) For April,(i) Calculate the break even sales revenue for the given product mix in the production plan.(ii) Calculate the margin of safety percentage.(iii) Explain THREE limitations of breakeven analysis for GF.

Step by Step Answer: