Mackerel Contracting (Mackerel) is a listed defence contractor working mainly for its domestic government in Zedland. At

Question:

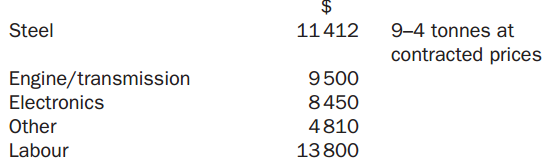

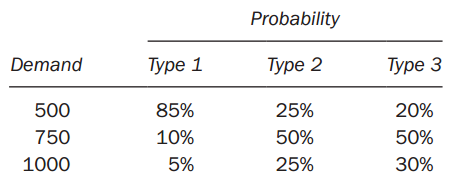

Mackerel Contracting (Mackerel) is a listed defence contractor working mainly for its domestic government in Zedland. At present, Mackerel is considering tendering for a contract to design and develop a new armoured personnel vehicle (APV) for the army to protect its soldiers during transport around a battlefield. The invitation to tender from the government specifies that the APV should take two years to develop and test, and be delivered for a full cost to Mackerel of no more than $70 000 per unit at current prices before Mackerel?s profit element. Normally, government contracts are approximately priced on a cost plus basis with Mackerel aiming to make a 19 percent mark-up.At the last briefing meeting, the institutional shareholders of Mackerel expressed concern about the volatility of the company?s earnings (currently a $20.4m operating profit per annum) especially during the economic downturn which is affecting Zedland at present. They are also concerned by cuts in government expenditure resulting from this recession. The Zedland minister for procurement has declared ?In the current difficult economic conditions, we are preparing a wide ranging review of all defence contracts with a view to deciding on what is desirable within the overall priorities for Zedland and what is possible within our budget?. The government procurement manager has indicated that the government would be willing to commit to purchase 500 APVs within the price limit set but with the possibility of increasing this to 750 or 1000 depending on defence commitments. In the invitation to tender document, the government has stated it will pay a fixed sum of $7.5m towards development and then a 19 percent mark-up on budgeted variable costs.Mackerel?s risk management committee (RMC) is considering how much to spend on design and development. It has three proposals from the engineering team: a basic design package (Type 1) and two other improved design packages (Type 2 and Type 3). The design packages will have different total fixed costs but are structured to give the same variable cost per unit. The basic design package will cost $7.5m to develop which will satisfy the contract specification. It is believed that the improved design packages will increase the chances of gaining a larger government order but it has been very difficult to ascertain the relevant probabilities of different order volumes. The RMC need a full appraisal of the situation using all suitable methods.The risk manager has gathered information on the APV contract which is contained in appendix A. She has identified that a major uncertainty in pricing the vehicle is the price of steel, as each APV requires 9.4 tonnes of steel. However, she has been successful in negotiating a fixed price contract for all the steel that might be required at $1214 per tonne. The risk manager has tried to estimate the effect of choosing different design packages but is unsure of how to proceed to evaluate the different options.You are a consultant brought in to advise Mackerel on the new contract. The RMC need a report which outlines the external factors affecting the profitability of the project and how these factors can be built into the choice of the design budget which is ultimately set.Appendix ABudgeted cost for APVVariable cost per unit

Design and development(fixed total) .................................$PackageType 1 ................................7 500 000Type 2 ................................8 750 000Type 3 ..............................10 000 000

Risk manager?s assessment of likely government order:

Required:Write a report to the risk management committee to:(i) Analyse the risks facing trie management of Mackerel and discuss how the management team?s attitude to risk might affect their response.(ii) Evaluate the APV project using metrics and methods. for decision-making under risk and uncertainty and assess the suitability of the different methods used.(iii) Recommend an appropriate choice of method of assessing the project and, therefore, a course of action for the APV contract.

Step by Step Answer: