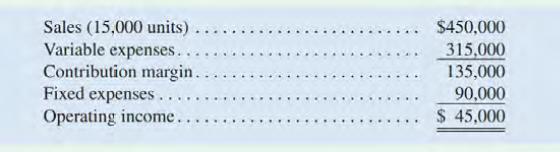

Lawson Manufacturing Company's (LMC) contribution format income statement for the most recent month is given below: LMC's

Question:

Lawson Manufacturing Company's (LMC) contribution format income statement for the most recent month is given below:

LMC's operating income is highly sensitive to changes in the operating environment, and management is considering ways to stabilize earnings and improve profitability.

Required:

1. New equipment has come on the market that would allow LMC to automate a portion of its operations. Variable costs would be reduced by $9 per unit. However, fixed costs would increase to a total of $225,000 each month. Prepare two contribution format income statements, one showing current operations and one showing how operations would appear if the new equipment is purchased. Show an Amount column, a Per Unit column, and a Percentage column on each statement. Do not show percentages for the fixed costs.

2. Refer to the income statements in (1) above. For both current operations and the proposed new operations, compute

(a) The degree of operating leverage.

(b) The break-even point in dollars.

(c) The margin of safety in both dollar and percentage terms.

3. Refer again to the data in (1) above. As a manager, what factor would be paramount in your mind in deciding whether to purchase the new equipment? (You may assume that ample funds are available to make the purchase.)

4. Refer to the original data. Rather than purchase new equipment, the marketing manager argues that the company's marketing strategy should be changed. Instead of paying sales commissions, which are included in variable expenses, the marketing manager suggests that salespeople be paid fixed salaries and that the company invest heavily in advertising. The marketing manager claims that this new approach would increase unit sales by 30% without any change in selling price, the company's new monthly fixed expenses would be $180,000, and its operating income would increase by 20%. Compute the break-even point in dollar sales for the company under the new marketing strategy. Do you agree with the marketing manager's proposal?

5. What level of sales under the new marketing strategy would generate the same operating income as the most recent month?

Step by Step Answer:

Managerial Accounting

ISBN: 9781260193275

12th Canadian Edition

Authors: Ray H. Garrison, Alan Webb, Theresa Libby