Question:

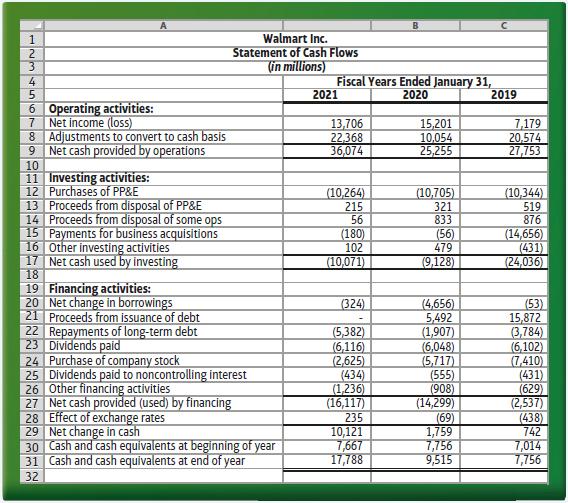

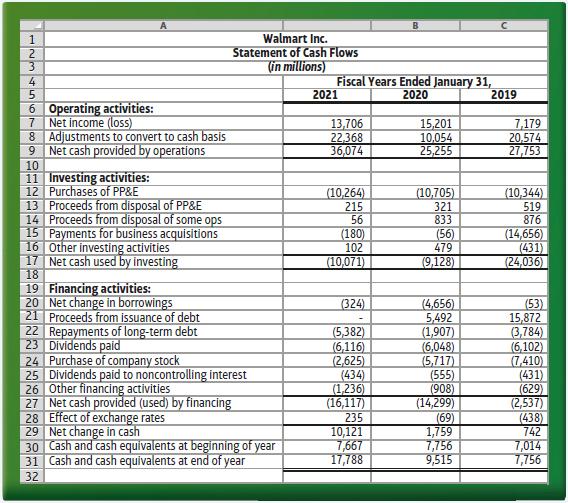

Walmart Inc. (NYSE: WMT) has a fiscal year end of January 31. To follow are its statements of cash flows for the fiscal years 2019–2021.

RequirementsUsing its statements of cash flows, answer the following questions about Walmart:a. Is Walmart generating cash from its operations?b. Describe what investing activities Walmart has been involved in over the past three years. Are investing activities an overall source or use of funds for Walmart?c. What financing activities has Walmart been undertaking in the past three years? Has it been paying dividends to its common stockholders? Has it been purchasing its own stock back?d. Why do you think Walmart has a fiscal year-end of January 31 rather than using a calendar year-end of December 31?

Transcribed Image Text:

1

2

3

4

5

6 Operating activities:

7 Net income (loss)

A

8 Adjustments to convert to cash basis

9 Net cash provided by operations

10

11 Investing activities:

12 Purchases of PP&E

13 Proceeds from disposal of PP&E

14 Proceeds from disposal of some ops

15 Payments for business acquisitions

16 Other investing activities

17 Net cash used by investing

18

19 Financing activities:

20 Net change in borrowings

21 Proceeds from issuance of debt

22 Repayments of long-term debt

23 Dividends paid

Walmart Inc.

Statement of Cash Flows

(in millions)

24 Purchase of company stock

25 Dividends paid to noncontrolling interest

26 Other financing activities

27 Net cash provided (used) by financing

28 Effect of exchange rates

29 Net change in cash

30 Cash and cash equivalents at beginning of year

31 Cash and cash equivalents at end of year

32

Fiscal Years Ended January 31,

2020

2021

13,706

22,368

36,074

(10,264)

215

56

(180)

102

(10,071)

(324)

(5,382)

(6,116)

(2,625)

(434)

(1,236)

(16,117)

235

10,121

7,667

17,788

15,201

10,054

25,255

(10,705)

321

833

(56)

479

(9,128)

(4,656)

5,492

(1,907)

(6,048)

(5,717)

(555)

(908)

(14,299)

(69)

1,759

7,756

9,515

2019

7,179

20,574

27,753

(10,344)

519

876

(14,656)

(431)

(24,036)

(53)

15,872

(3,784)

(6,102)

(7,410)

(431)

(629)

(2,537)

(438)

742

7,014

7,756