Refer to the financial statements and other data in Problem 16-18. Assume Paul Sabin has asked you

Question:

Refer to the financial statements and other data in Problem 16-18. Assume Paul Sabin has asked you to assess his company’s profitability and stock market performance.

Required:

1. You decide first to assess the company’s stock market performance. For both this year and last year, compute:

a. The earnings per share. There has been no change in common stock over the last two years.

b. The dividend yield ratio. The company’s stock is currently selling for $40 per share; last year it sold for $36 per share.

c. The dividend payout ratio.

d. The price-earnings ratio. How do investors regard Sabin Electronics as compared to other companies in the industry if the industry norm for the price-earnings ratio is 12? Explain.

e. The book value per share of common stock. Does the difference between market value and book value suggest that the stock is overpriced? Explain.

2. You decide next to assess the company’s profitability. Compute the following for both this year and last year:

a. The gross margin percentage.

b. The net profit margin percentage.

c. The return on total assets. (Total assets at the beginning of last year were $2,420,000.)

d. The return on equity. (Stockholders’ equity at the beginning of last year was $1,420,000.)

e. Is the company’s financial leverage positive or negative? Explain.

3. Comment on the company’s profit performance and stock market performance over the two year period.

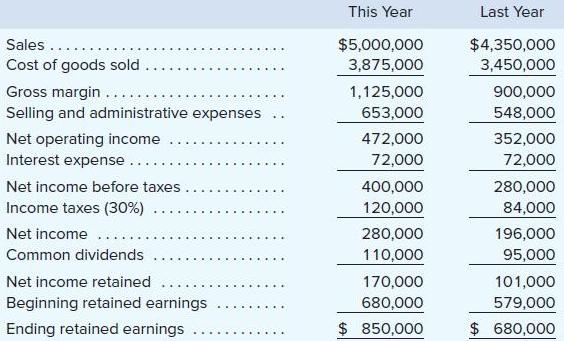

Data From Problem 16-18:

Sabin Electronics

Comparative Income Statement and Reconciliation

Step by Step Answer:

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer