Perkins Co.s current asset and liability balances for the past two years are as follows. Net income

Question:

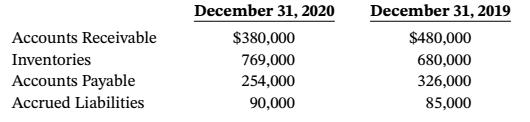

Perkins Co.’s current asset and liability balances for the past two years are as follows. Net income for 2020 was $1,369,000, and depreciation expense was $70,000.

December 31, 2020 December 31, 2019 Accounts Receivable $380,000 $480,000 Inventories 769,000 680,000 Accounts Payable 254,000 326,000 Accrued Liabilities 90,000 85,000

Step by Step Answer:

Cash flows from operating activities Net income 1369000 Adju...View the full answer

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Perkins Co.'s current asset and liability balances for the past two years are as follows. Net income for 2016 was $1,252,000, and depreciation expense was $60,000....

-

Income statements for Mariners Corp. for the past two years are as follows: Required 1. Using the format in Example 13-5, prepare common-size comparative income statements for the two years for...

-

Income statements for Mariners Corp. for the past two years are as follows: Required 1. Using the format in Example 13-5, prepare common-size comparative income statements for the two years for...

-

The Justice Department has been asked to review a merger request for a market with the following four firms. Firm Assets A .......... $156 million B .......... 130 million C .......... 45 million D...

-

Discuss why it is difficult to justify CRM applications?

-

The price - earnings ratio is the same amount as the market value per share. O True O False The purchase of treasury stock is reported on the statement of cash flows as a financing activity. O True O...

-

2. Suppose you have just taken over the management of a department that has just begun to use a new information system. Assume that the information system has not been reliable and is difficult to...

-

The T-accounts below summarize the ledger of Salvador's Gardening Company, Inc. at the end of the first month of operations. Instructions (a) Prepare the journal entries (including explanations) that...

-

Q4. Based on the following statement of financial position find working capital; current ratio; quick ratio; and cash ratio

-

Compute a depth-two decision tree for the training data in table 1 using the Gini function, C(a) = 2a(1 a) as described in class. What is the overall accuracy on the training data of the tree? XYZ...

-

What are investing activities? Give one example.

-

What might a trend toward providing cash through investing activities suggest about a business?

-

Operating at an 80 percent learning rate, the first unit took 72 hours to produce. Use the Learning Curve Excel template to determine how long the 32nd unit will take. What is the cumulative average...

-

The balances of selected accounts of Casper Company on February 28, 20X1, were as follows: Sales $250,000 and Sales Returns and Allowances $4,000. The firm's net sales are subject to an 7 percent...

-

1. Draw and label force diagrams for the physics book and for the calculator. Add equality marks showing any equalities between force diagrams. Circle and label any Newton's third law pairs. (6 pts)...

-

Consider the Lincoln Tunnel, which was built in 1939 under the Hudson River in New York. Assume the tunnel to be empty with perfectly conducting walls and rectangular cross section with width 6.55 m...

-

Examine a well-known principal-agent contract, the sale of your home by a licensed realtor. You will use the following data to analyze this case. Your home is the typical home, approximately 1,875 sq...

-

i) Generate a third degree polynomial in x and y named g(x, y) that is based on your mobile number (Note: In case there is a 0 in one of the digits replace it by 3). Suppose your mobile number is...

-

Test for exactness. If exact, solve. If not, use an integrating factor as given or obtained by inspection or by the theorems in the text. Also, if an initial condition is given, find the...

-

Find the image of x = k = const under w = 1/z. Use formulas similar to those in Example 1. y| y = 0 -21 -2 -1 -1, /1 12 T -1 -1 y= -2 x =0

-

AOZT Volzhskije Motory of St. Petersburg, Russia, makes marine motors for vessels ranging in size from harbor tugs to open-water icebreakers. (The Russian currency is the ruble, which is denoted by...

-

Gitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). All materials...

-

High Desert Potteryworks makes a variety of pottery products that it sells to retailers such as Home Depot. The company uses a job-order costing system in which predetermined overhead rates are used...

-

A company is evaluating a new 4-year project. The equipment necessary for the project will cost $3,300,000 and can be sold for $650,000 at the end of the project. The asset is in the 5-year MACRS...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

I need to see where the calculations for this problem come from plz. 5. Award: 4.00 points Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement...

Study smarter with the SolutionInn App