Kids + Kites Ltd sells all kinds of childrens toys. The entitys accountant, Fred Heights, was preparing

Question:

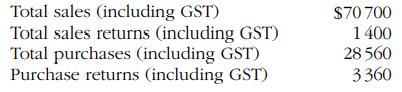

Kids + Kites Ltd sells all kinds of children’s toys. The entity’s accountant, Fred Heights, was preparing the information needed to account for the GST and report to the taxation authority for the quarter ending 31 March 2016, when he came down with a nasty flu and had to stay at home. You have been hired to take over Fred’s role until he recovers. Before Fred fell ill, he prepared the following information for the quarter:

Required

(a) Journalise the sales and purchases transactions, as well as payment of GST to the taxation authority, using the GST Paid and GST Collected accounts.

(b) Journalise the sales and purchases transactions, as well as payment of GST to the taxation authority, using the GST Clearing account.

(c) Assuming the total net sales for the quarter were $28 560 (including GST) and the total net purchases were $70 700 (including GST), journalise the sales and purchases transactions, as well as the refund from the taxation authority, using the GST Paid and GST Collected accounts.

(d) Using the same information as in part (c), journalise the sales and purchases transactions, as well as the refund from the taxation authority, using the GST Clearing account.

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong