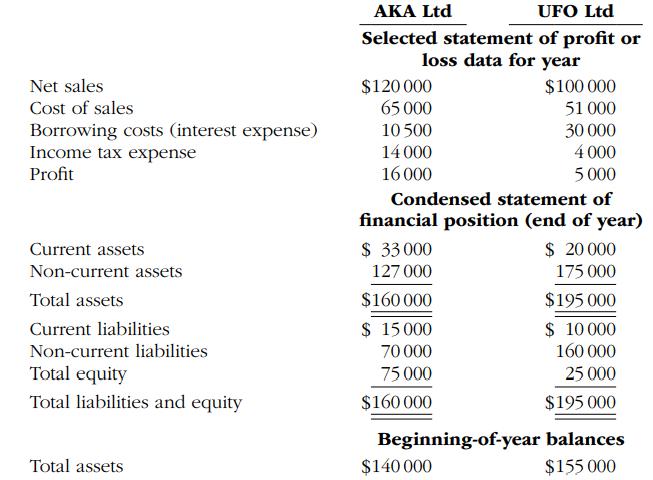

Selected financial data (in thousands) of two competitors, AKA Ltd and UFO Ltd, for 2015 are presented

Question:

Selected financial data (in thousands) of two competitors, AKA Ltd and UFO Ltd, for 2015 are presented here:

Required

For each entity, calculate these values and ratios:

(a) Working capital.

(b) Current ratio.

(c) Debt to total assets ratio.

(d) Return on assets.

(e) Profit margin.

(f) Compare the liquidity, solvency and profitability of the two entities.

Transcribed Image Text:

Net sales Cost of sales Borrowing costs (interest expense) Income tax expense Profit Current assets Non-current assets Total assets Current liabilities Non-current liabilities Total equity Total liabilities and equity Total assets AKA Ltd UFO Ltd Selected statement of profit or loss data for year $120 000 65 000 10 500 14 000 16000 Condensed statement of financial position (end of year) $ 33.000 127 000 $160 000 $ 15000 70 000 75 000 $160 000 $100 000 51 000 30 000 4000 5 000 $140 000 $ 20 000 175 000 $195 000 $ 10 000 160 000 25 000 $195 000 Beginning-of-year balances $155 000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

a Working capital AKA Ltd 33000 15000 18000 UFO Ltd 20000 10000 10000 b Current ratio AKA Ltd ...View the full answer

Answered By

Rodrigo Louie Rey

I started tutoring in college and have been doing it for about eight years now. I enjoy it because I love to help others learn and expand their understanding of the world. I thoroughly enjoy the "ah-ha" moments that my students have. Interests I enjoy hiking, kayaking, and spending time with my family and friends. Ideal Study Location I prefer to tutor in a quiet place so that my students can focus on what they are learning.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong

Question Posted:

Students also viewed these Business questions

-

The financial statements of Apple Inc. for 2015 are presented in Appendix A. Instructions for accessing and using the company's complete annual report, including the notes to the financial...

-

Selected financial data in thousands of dollars for the Hunter Corporation are listed in the text. a. Calculate Hunters rate of return on total assets in 2015 and in 2014. Did the ratio improve or...

-

Amber Ltd. increased its debt to total assets ratio from 40% to 60% over the past year and its times interest earned ratio rose from 3.0 times to 3.8 times. Meanwhile, Baxter Inc. also increased its...

-

John Black is considering to purchasing a land from Real Estate Ltd for $1,000,000. The terms of the agreement are, 10% down payment, and the balance is to be repaid at 20% interest for duration of...

-

Deflate the dollar sales volumes in Table P-24 using the commodity price index. These indexes are for all commodities, with 2001 = 100. TABLE P-24 Commodity Price Inder Volume (S) (2001 100) Sales...

-

An archer is able to fire an arrow (mass 0.020 kg) at a speed of 250 m/s. If a baseball (mass 0.14 kg) is given the same kinetic energy, what is its speed?

-

Record the retirement of bonds. (p. 409) AppendixLO1

-

Compute the missing amount for Felix Company. You will need to work through total stockholders equity. Requirements 1. Did Felix earn a net income or suffer a net loss for the year? Compute the...

-

Peng Company is considering buying a machine that will yield income of $2,300 and net cash flow of $16,200 per year for three years. The machine costs $48,900 and has an estimated $7,200 salvage...

-

A load of lumber is lifted using a triple leg sling. Knowing that at the instant shown the lumber is at rest and that the tension in leg AD is 220 lb, determine the weight of the lumber. 65H

-

Selected financial data (in thousands) of two competitors, New Ltd and Old Ltd, for 2015 are presented here: Required For each entity, calculate these values and ratios: (a) Working capital. (b)...

-

An extract from the general ledger of Retail Limited for the year ended 30 June 2015 appears as follows: Additional information: Cash paid to suppliers $84 500 All other expenses were paid in cash...

-

a. Given the following product structure tree for product E, determine the quantity of each component required to assemble one unit of E. b. Draw the product structure tree for a stapler using its...

-

Q. Probabilities of three teams A, B and C of winning the first prize of a business case competition are 3/9, 2/9, 3/9 respectively. These three teams are equally likely to win the prize. True False...

-

Univex is a calendar year, accrual basis retail business. Univex hold less than 20% of IBM stock. Its financial statements provide the following information for the year: Revenues from sales of goods...

-

Consider the unadjusted trial balance of Fabuloso, Inc. at December 31, 2023, and the related month-end adjustment data. (Click the icon to view the month-end adjustment data.) Requirements 1....

-

5.3 BEP Example Bill Braddock is considering opening a Fast 'n Clean Car Service Center. He estimates that the following costs will be incurred during his first year of operations: Rent $9,200,...

-

The following is the text for an opinion on internal control for W Company, an issuer. Some words or phrases have been replaced with numbers (e.g., [1], [2], etc.). Select from the option list...

-

Two persons who worked together to develop a business method applied for a patent. The invention for which they sought a patent explained how buyers and sellers of commodities in the energy market...

-

Suppose you need to answer any four of seven essay questions on a history test and you can answer them in any order. a. How many different question combinations are possible? b. What is the...

-

In the current year, Wilson Enterprises, a calendar year taxpayer, suffers a casualty loss of $90,000. How much of the casualty loss will be deductible by Wilson under the following circumstances? a....

-

Benton Company (BC) has one owner, who is in the 33% Federal income tax bracket. BCs gross income is $395,000, and its ordinary trade or business deductions are $245,000. Compute the Federal income...

-

In the current year, Tanager Corporation (a C corporation) had operating income of $480,000 and operating expenses of $390,000. In addition, Tanager had a long-term capital gain of $55,000 and a...

-

Julia Co. purchased a trading debt security on October 4 of the current year for $50,000. The market value of the stock investment at year-end is $47,000. What value will be reported in net income...

-

1. (A nice inharitage) Suppose $1 were invested in 1776 at 3.3% interest compounded yearly a) Approximatelly how much would that investment be worth today: $1,000, $10,000, $100,000, or $1,000,000?...

-

Why Should not the government subsidize home buyers who make less than $120K per year. please explain this statement

Study smarter with the SolutionInn App