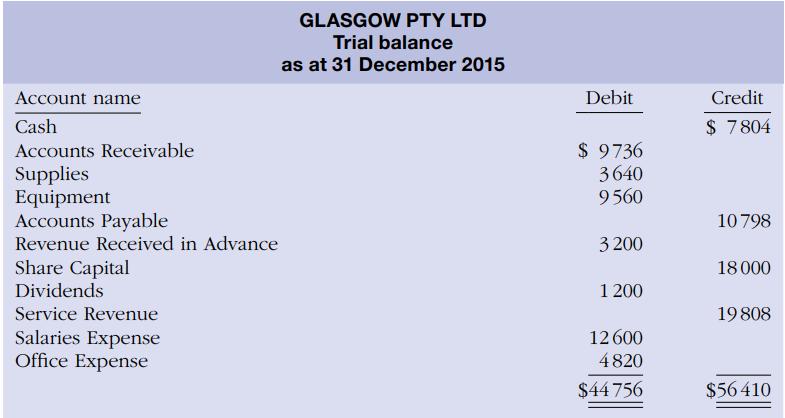

This trial balance for Glasgow Pty Ltd does not balance. Each of the listed accounts has a

Question:

This trial balance for Glasgow Pty Ltd does not balance.

Each of the listed accounts has a normal balance. An examination of the ledger and journal reveals the following errors:

1. Cash received from a customer on account was debited to Cash for $1680 and Accounts Receivable was credited for the same amount. The actual collection was for $960.

2. The purchase of a printer on account for $440 was recorded as a debit to Supplies for $440 and a credit to Accounts Payable for $440.

3. Services were performed on account by a client for $1280. Accounts Receivable was debited $1280 and Service Revenue was credited $128.

4. A debit posting to Salaries Expense of $1800 was omitted.

5. A payment made on account for $818 was credited to Cash for $818 and credited to Accounts Payable for $980.

6. Payment of a $1200 cash dividend to shareholders was debited to Salaries Expense for $1200 and credited to Cash for $1200.

Required

(a) Prepare the correct trial balance.

(b) Explain what adjustments were made and why they were necessary.

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong