Korosa and Delancey, Ltd. is studying the acquisition of two electrical component insertion systems for producing its

Question:

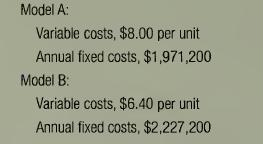

Korosa and Delancey, Ltd. is studying the acquisition of two electrical component insertion systems for producing its sole product, the universal gismo. Data relevant to the systems follow.

Korosa and Delancey's selling price is \($32\) per unit for the universal gismo, which is subject to a 5 percent sales commission. (In the following requirements, ignore income taxes.)

Required:

1. How many units must the company sell to break even if Model A is selected?

2. Which of the two systems would be more profitable if sales and production are expected to average 184,000 units per year?

3. Assume Model B requires the purchase of additional equipment that is not reflected in the preceding figures. The equipment will cost \($900,000\) and will be depreciated over a five-year life by the straight-line method. How many units must the company sell to earn \($1,912,800\) of income if Model B is selected?

4. Ignoring the information presented in requirement (3), at what volume level will management be indifferent between the acquisition of Model A and Model B? In other words, at what volume level will the annual total cost of each system be equal?

Step by Step Answer:

Managerial Accounting Creating Value In A Dynamic Business Environment

ISBN: 9780071113144

6th Edition

Authors: Ronald W Hilton