Lehighton Chalk Company had no beginning or ending work-in-process inventories for either year. 1. Prepare operating income

Question:

Lehighton Chalk Company had no beginning or ending work-in-process inventories for either year.

1. Prepare operating income statements for both years based on absorption costing.

2. Prepare operating income statements for both years based on variable costing.

3. Prepare a numerical reconciliation of the difference in income reported under the two costing methods used in requirements 1 and 2.

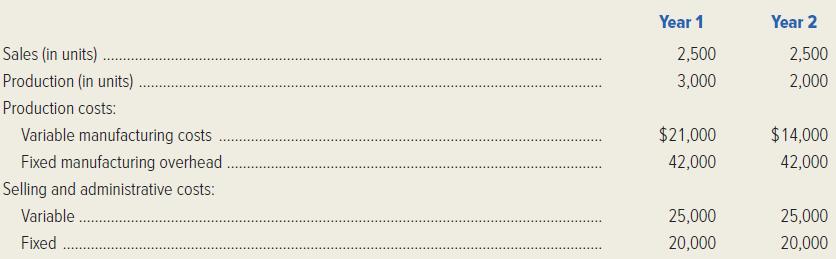

Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $50 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Lehighton’s first two years of operation is as follows:

Step by Step Answer:

Managerial Accounting Creating Value in a Dynamic Business Environment

ISBN: 978-1260417043

12th edition

Authors: Ronald Hilton, David Platt