1. The breakeven point is that point where: a. total sales revenue equals total variable and fixed...

Question:

1. The breakeven point is that point where:

a. total sales revenue equals total variable and fixed expenses.

b. total contribution margin equals total fixed expenses.

c. Both a and \(\mathrm{b}\) are correct.

d. Neither a nor b is correct.

2. Garth Company sells a single product that generates a positive contribution margin. If the selling price per unit and the variable cost per unit both increase \(10 \%\) and fixed costs do not change, the:

3. Honeybee Company's contribution margin ratio is \(60 \%\); the company's breakeven point in sales is \(\$ 150,000\). If the company wants to earn net income of \(\$ 60,000\) over the period, its sales would have to be:

a. \(\$ 200,000\).

b. \(\$ 350,000\).

c. \(\$ 250,000\).

d. \(\$ 210,000\).

4. Carlton Company sells its product for \(\$ 40\) per unit. The company's variable costs are \(\$ 22\) per unit; its fixed costs are \(\$ 82,800\) a year. Carlton's breakeven point is:

a. \(\$ 184,000\).

b. 3,764 units.

c. \(\$ 150,545\).

d. 2,070 units.

5. Fixed manufacturing overhead costs are allocated to each unit of product using:

a. the absorption-costing method only.

b. the variable-costing method only.

c. both the absorption- and variable-costing methods.

d. neither the absorption-nor the variable-costing method.

6. Last year Clarence Company sold 3,600 units at a price of \(\$ 50\) per unit. The company's variable cost per unit was \(\$ 15\); its fixed costs for the year were \(\$ 40,530\). If the company wants a profit of \(\$ 40,000\) next year, all other factors remaining constant, it will have to sell:

a. 1,158 units.

b. 1,958 units.

c. 2,300 units.

d. 800 units.

7. When production exceeds sales, absorption-costing net income generally:

a. is less than variable-costing net income.

b. is more than variable-costing net income.

c. equals variable-costing net income.

d. is higher or lower than variable-costing net income because no generalization can be made.

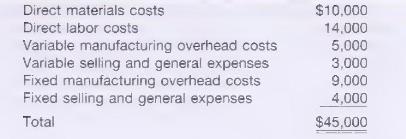

8. Last year, Bone Company produced 10,000 units of product \(\mathrm{X}\) and incurred the following costs:

Under absorption costing, any unsold units of product \(\mathrm{X}\) would be carried in Finished Goods Inventory at a unit cost of:

a. \(\$ 4.50\).

b. \(\$ 4.20\).

c. \(\$ 3.80\).

d. \(\$ 2.90\).

9. Selling and administrative expenses are:

a. a product cost under variable costing.

b. a product cost under absorption costing.

c. part of fixed manufacturing overhead under variable costing.

d. a period expense under both variable and absorption costing.

10. Last year Smith Company had net income of \(\$ 125,000\) using variable costing and \(\$ 105,000\) using absorption costing. The company's variable production costs were \(\$ 20\) per unit; its total fixed overhead was \(\$ 176,000\). The company produced 11,000 units. Production levels and fixed costs have not changed in three years. During the year, Smith's finished goods inventory:

a. increased by 1,000 units.

c. decreased by 1,000 units.

b. increased by 1,250 units.

d. decreased by 1,250 units.

Step by Step Answer:

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill