A. For financial reporting purposes, are Tim and Ann's salaries and expenses considered a product cost or

Question:

A. For financial reporting purposes, are Tim and Ann's salaries and expenses considered a product cost or a period expense?

B. As illustrated in the problem, top management at Georgia Industries has established different compensation systems for manufacturing and sales employees. These managers made their decisions, based on an understanding of cost behavior, to help reduce risks and to motivate certain types of behavior. Would you classify Ann's salary as fixed, variable, or mixed? Why?

C. What type of behavior are managers at Georgia Industries attempting to motivate?

D. Does this type of compensation package reduce risk for Georgia Industries? Explain.

E. Describe various types of analyses the partners might conduct using monthly financial information.

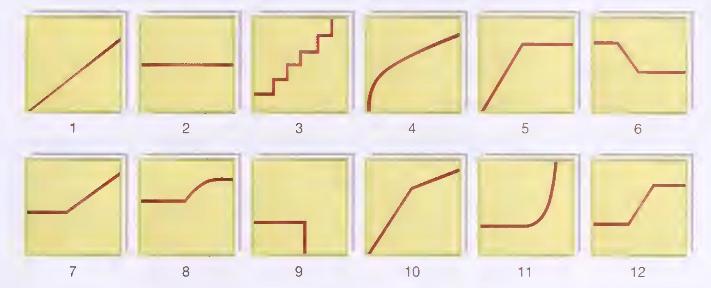

A. Cost of raw materials, where the cost decreases by 6 cents per unit for each of the first 150 units purchased, after which it remains constant at \(\$ 2.75\) per unit.

B. City water bill, which is computed as follows:

First 750,000 gallons or less \(\$ 1,000\) flat fee Next 15,000 gallons \(\$ 0.002\) per gallon used Next 15,000 gallons \(\$ 0.005\) per gallon used Next 15,000 gallons \(\$ 0.008\) per gallon used Etc. Etc.

C. Rent on a factory building donated by the city, where the agreement provides for a fixed-fee payment, unless 250,000 labor hours are worked, in which case no rent needs to be paid.

D. Cost of raw materials used.

E. Electricity bill-a flat fixed charge of \(\$ 250\) plus a variable cost after 150,000 kilowatthours are used.

F. Salaries of maintenance workers if one maintenance worker is needed for every 1,000 hours or less of machine time.

G. Depreciation of equipment using the straight-line method.

H. Rent on a factory building donated by the county, where the agreement provides for a monthly rental of \(\$ 100,000\) less \(\$ 1\) for each labor hour worked in excess of 200,000 hours. However, a minimum rental payment of \(\$ 20,000\) must be made each month.

I. Rent on a machine that is billed at \(\$ 1,000\) for up to 500 hours of machine time. After 500 hours of machine time, an additional charge of \(\$ 1\) per hour is paid up to a maximum charge of \(\$ 2,500\) per period.

(Material from the Uniform CPA Examination Questions and Unofficial Answers, Copyright @ by the American Institute of Certified Public Accountants, Inc., is reprinted [or adapted] with permission.)

Step by Step Answer:

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill