Binley Blades specializes in the manufacture of rotor blades for helicopters. It has just spent 50,000 developing

Question:

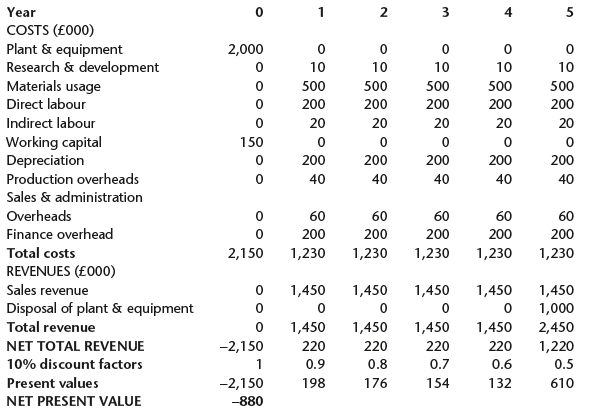

Binley Blades specializes in the manufacture of rotor blades for helicopters. It has just spent £50,000 developing a new type of blade based on a mixture of carbon fibre and naturally occurring resins. These blades can withstand 80% more stress than the company’s standard blades but will cost approximately 50% more to manufacture. It now has to decide whether to go ahead and build a new production facility for its new blades. Unfortunately, the net present value analysis (reproduced below) indicates that it would be most unwise to go ahead with this project.

Notes:1. It is company policy to write off research and development costs over the lifetime of the product.2. It is company policy to use straight-line depreciation over 10 years, with a zero residual value, for plant and equipment.3. The company is currently developing an even stronger blade which uses a very different technology. Binley thinks it will take a further five years before it is ready for production. Thus, Binley considers that the carbon fibre/resin project will have a life of five years, at the end of which the plant and equipment will be sold off at 25% of its original cost.4. The necessary plant and equipment will be purchased for £2 million, financed in full by a bank loan for this amount, bearing interest at 10% a year (shown above as ‘Finance overhead’).5. The working capital consists of carbon fibre and resin material stocks.6. Only half of the indirect labour costs will be actually caused by this project. The other half is a redistribution from standard blade production.7. Only 12.5% of the production overheads will actually be caused by this project. The remainder is a redistribution from standard blade production.8. Binley believes that its current marketing and administration departments will be able to cope with any increased workloads. The overheads shown are a redistribution from standard blade production.

Task:Redraft the above schedule, correcting any mistakes you find. Comment briefly on your results.

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor