Comparing Traditional and Activity-Based Product Margins [LO1, LO3, LO4, LO5] Precision Manufacturing Inc. (PMI) makes two types

Question:

Comparing Traditional and Activity-Based Product Margins [LO1, LO3, LO4, LO5]

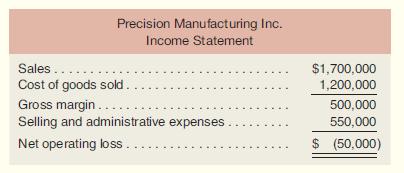

Precision Manufacturing Inc. (PMI) makes two types of industrial component parts—the EX300 and the TX500. An absorption costing income statement for the most recent period is shown below:

PMI produced and sold 60,000 units of EX300 at a price of $20 per unit and 12,500 units of TX500 at a price of $40 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base.

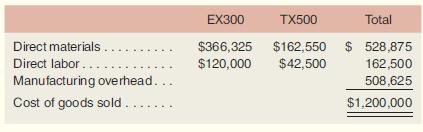

Additional information relating to the company’s two product lines is shown below:

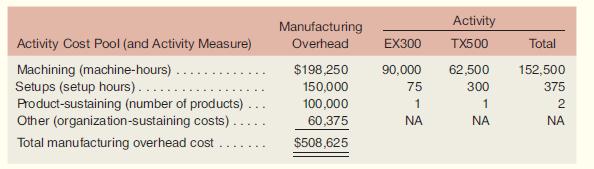

The company has created an activity-based costing system to evaluate the profi tability of its products. PMI’s ABC implementation team concluded that $50,000 and $100,000 of the company’s advertising expenses could be directly traced to EX300 and TX500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company’s manufacturing overhead to four activities as shown below:

Required:

1. Using Exhibit 7–12 as a guide, compute the product margins for the EX300 and TX500 under the company’s traditional costing system.

2. Using Exhibit 7–10 as a guide, compute the product margins for EX300 and TX500 under the activity-based costing system.

3. Using Exhibit 7–13 as a guide, prepare a quantitative comparison of the traditional and activity-based cost assignments. Explain why the traditional and activity-based cost assignments di ffer.

Step by Step Answer: