ObJ. 2 The accounting firm of Lawton and Smith provides tax preparation services for its clients. Secretaries

Question:

ObJ. 2 The accounting firm of Lawton and Smith provides tax preparation services for its clients. Secretaries typically contact the client to schedule an appointment. When a client arrives at the firm's office, a partner conducts an interview and collects documentation supporting the information for the tax return. A staff accountant is given the interview notes and supporting documents, such as Form W-2 and cancelled checks, and enters the data into a computer program. The partner is responsible for reviewing the accuracy of the return before a secretary duplicates and packages it.

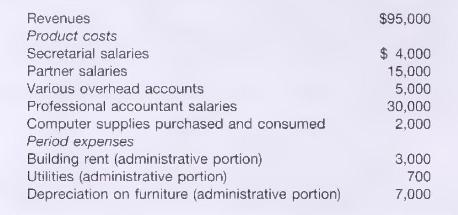

During the month of March, Lawton and Smith incurred revenue and costs as follows:

The company maintained insignificant balances of supplies that can be ignored, but reported work-in-process and finished services inventories on March 1 as \(\$ 20,000\) and \(\$ 5,000\), respectively. On March 31, the company reported work-in-process and finished services inventories as \(\$ 15,000\), and \(\$ 7,000\), respectively.

\section*{Required}

A. Identify each product cost as direct materials, direct labor, or overhead.

B. Calculate the cost of services provided (cost of goods sold) during March.

C. Calculate cost of services sold percentage and the gross margin percentage as a percentage of revenues.

D. How might your analysis support partners in decisions concerning the firm?

Step by Step Answer:

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill