Office Supply 4U manufactures staplers. The activity base used to allocate overhead is direct Obj. 2 labor

Question:

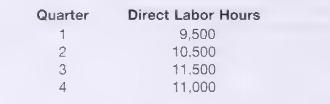

Office Supply 4U manufactures staplers. The activity base used to allocate overhead is direct Obj. 2 labor hours. The variable overhead rate is estimated at \(\$ 1.50\) per direct labor hour for 2004 . The fixed overhead is budgeted at \(\$ 20,000\) per quarter, of which \(\$ 5,000\) represents depreciation. The budgeted direct labor hours are as follows:

Prepare a manufacturing overhead budget for 2004, showing the total budgeted manufacturing overhead and the cash disbursements for manufacturing overhead by quarter and for the year in total. (Hint: Is there a periodic cash flow associated with depreciation?)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill

Question Posted: