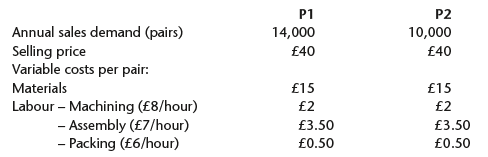

Profoot currently makes and sells two types of protective shoe, model P1 and model P2. Annual total

Question:

Profoot currently makes and sells two types of protective shoe, model P1 and model P2.

Annual total fixed costs are currently £300,000.

For the next financial year, Profoot intends to keep model P1 as it is but to upgrade model P2 by the use of better materials. The materials cost for P2 is expected to be £20 a pair (an increase of £5 a pair) and its new selling price will be £50 a pair. Also, the amount of time spent machining P2s will double and the cost of this will increase to £4 a pair. Also, next year, Profoot intends to introduce the PDL, a top-of-the-range model with a selling price of £65. Labour costs for machining will be £4 a pair, assembly £7 a pair and packing £0.50 a pair. Materials will cost £32.50 a pair. Demand for the P1, P2 and PDL next year is predicted to be 14,000, 7,000 and 5,000 pairs respectively. Annual fixed costs are expected to increase by 2% next year.

Tasks:1. Calculate the annual net profit for the current year.2. Calculate the annual net profit for next year assuming the predicted demand is met in full.3. If the maximum number of machine hours available next year is 8,500, create a production plan to maximize net profit. (Clearly show the quantity of each model produced and calculate the net profit.)4. Profoot could purchase an additional machine costing £420,000 which would last for 10 years and have no residual value at the end of that period. This machine could be used for a maximum of 1,750 hours a year. How would the purchase of this machine affect next year’s net profit?

Step by Step Answer:

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor