Davis Company provided the following partial comparative balance sheets and the income statement for 20X2. Required: Compute

Question:

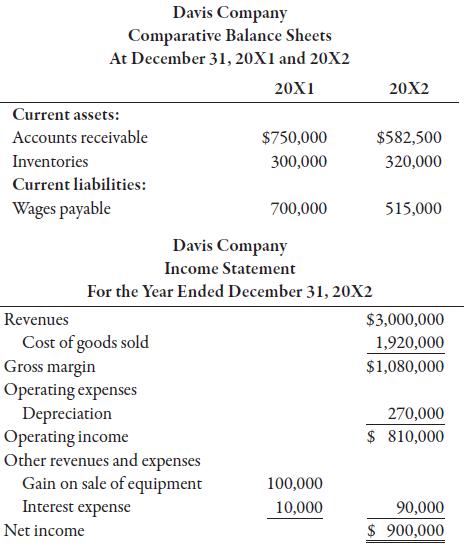

Davis Company provided the following partial comparative balance sheets and the income statement for 20X2.

Required:

Compute operating cash flows using the indirect method.

Transcribed Image Text:

Davis Company Comparative Balance Sheets At December 31, 20X1 and 20X2 20X1 Current assets: Accounts receivable Inventories Current liabilities: Wages payable Revenues Cost of goods sold $750,000 300,000 Davis Company Income Statement For the Year Ended December 31, 20X2 Gross margin Operating expenses Depreciation Operating income Other revenues and expenses Gain on sale of equipment Interest expense Net income 700,000 100,000 10,000 20X2 $582,500 320,000 515,000 $3,000,000 1,920,000 $1,080,000 270,000 $ 810,000 90,000 $ 900,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

Net income Add deduct adjusting items Decrease in ...View the full answer

Answered By

Shebla K

I am an MBA graduate having experience as an Assistant Professor at University level for two years. I always prepare well for a class as I believe that only if you become an ocean you can give a bucket of water. Being a teacher was not only my profession but also my passion.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Managerial Accounting The Cornerstone Of Business Decision Making

ISBN: 9780357715345

8th Edition

Authors: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Question Posted:

Students also viewed these Business questions

-

Blaylock Company provided the following partial comparative balance sheets and the income statement for 2016. Blaylock Company Income Statement For the Year Ended December 31, 2016 Revenues...

-

Belnap Company has provided the following partial comparative balance sheets and the income statement for 20X2. Belnap Company Income Statement For the Year Ended December 31, 20X2...

-

You are given the following prices for zero coupon bonds with $1,000 face amount: One-year bond Two-year bond Three year bond $945 $920 $900 Find the price today for a two-year 4% coupon bond.

-

What is the function of the ODMG Object Definition Language?

-

Explain the need for a code of professional ethics for professionals. How should the accountants' code of ethics be similar to and different from that of other professional groups, such as legal...

-

Q4 How can you use collaboration systems to control workflow?

-

Briefly describe some of the similarities and differences between U.S. GAAP and iGAAP with respect to the accounting for cash and receivables.

-

Speed, Inc., is a shipping company. On 1/1/20, the company purchases a new commercial sleeper truck for $860,000 cash The expected residual value of the truck is $60,000 and the expected useful life...

-

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2020: 1....

-

The income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Also, assume that the price per common share for Somerville is $8.10. Required: 1....

-

Find the most general antiderivative of the function. (Check your answer by differentiation.) f(x) = 3x - 2x

-

Discuss the difference between solving word problems in textbooks and problem solving outside the classroom.

-

Most human behaviour: can be easily explained has multiple causes stems from unconscious desires depends on social influence

-

In what ways are the information processing theories of cognitive development discussed in PSY393 different from the embodied cognition perspective? In what ways are they similar? In your opinion,...

-

Problem 15-6B Accounting for share investments LO4 CHECK FIGURE: 2. Carrying value per share, $19.63 River Outdoor Supply Corporation (River Corp.) was organized on January 2, 2023. River Corp....

-

21 West Coast Tours runs boat tours along the west coast of British Columbia. On March 5, 2023, it purchased, with cash, a cruising boat for $936,000, having a useful life of 10 years or 13,800...

-

02 P4-3B. Multi-step Income Statement The adjusted trial balance of Patton Corporation on December 31 is shown below. PATTON CORPORATION Adjusted Trial Balance December 31 Debit Credit Cash.......

-

Match each equation of an ellipse in Column I with the appropriate intercepts in Column II. () 36? + 9y2 324 (b) 92 + 362 3 324 y2 A. (-3,0). (3, 0). (0, -6), (0, 6) B. (-4,0), (4, 0), (0, 5), (0,...

-

The value of a share of common stock depends on the cash flows it is expected to provide, and those flows consist of the dividends the investor receives each year while holding the stock and the...

-

During 2011, Baker Company had the following transactions: a. Purchased $100,000 of 10-year bonds issued by Makenzie, Inc. b. Acquired land valued at $35,000 in exchange for machinery. c. Sold...

-

Tidwell Company experienced the following during 2011: a. Sold preferred stock for $480,000. b. Declared dividends of $150,000 payable on March 1, 2012. c. Borrowed $575,000 from bank on a two-year...

-

Refer to the information for Oliver Company given below: Information for Oliver Company Oliver Company provided the following information for the years 2011 and 2012: Required: Prepare a schedule...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Difference between Operating Leverage and Financial Leverage

-

bpmn diagram for misc purchases

Study smarter with the SolutionInn App