Muskogee Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this

Question:

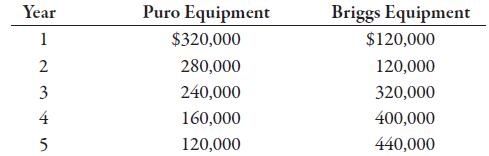

Muskogee Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this equipment are being considered as sources of the equipment. Aftertax cash inflows for the two competing projects are as follows:

Both projects require an initial investment of $560,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Required:

1. Assuming a discount rate of 12%, compute the net present value for each competing project. Which project should be chosen? Review the data analytic types in Exhibit 2.2. Which data analytic type or types are being used for this requirement? Explain.

2. A third option has surfaced for equipment purchased from an out-of-state supplier. The cost is also $560,000, but this equipment will produce even cash flows over its 5-year life. What must the annual cash flow be for this equipment to be selected over the other two? Assume a 12% discount rate.

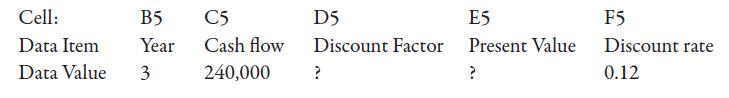

3. The following information is provided for Year 3 for the Puro equipment. The cell row is for an Excel spreadsheet.

a. Using the cell notation given, prepare and show the written versions of the Excel equations that you used to provide the derived data for the question marks, where the discount factor (D5) is rounded to five decimal places and the present value (E5) is the product of cash flow and the discount factor is rounded to the nearest dollar.

b. In Excel, following the pattern of Part 3a, create similar rows that run consecutively for all project years (Years 0 through 5). For the Puro project with the Year 0 row starting at Cell B2, Year 1 at Cell B3, Year 2 at Cell B4, etc. However, use F5 (the discount rate) as a data source for all rows. Finally, calculate the NPV using a summation equation for the Present Value column. Provide a written version of the Excel summation equation that you used.

c. Create a similar set of Excel rows, columns, and equations for the Briggs equipment project.

d. The finance manager believes that cash flows of $260,000 per year are a better estimate for the Puro equipment than the original forecast. She also believes that the required rate of return should be 14%. Using the Excel NPV program from Parts 3b and 3c, calculate the NPV for each competing investment using the new cash forecast (for Puro) and a discount rate of 14%.

Step by Step Answer:

Managerial Accounting The Cornerstone Of Business Decision Making

ISBN: 9780357715345

8th Edition

Authors: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger