Rocket Motors manufactures sterndrive engines for pleasure craft boats. Rockets management is concerned about increasing competition in

Question:

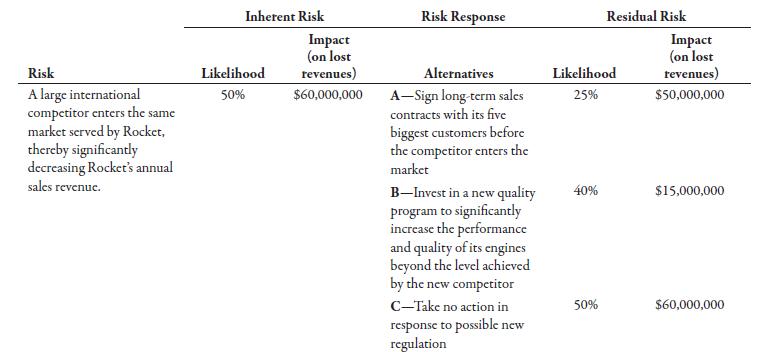

Rocket Motors manufactures sterndrive engines for pleasure craft boats. Rocket’s management is concerned about increasing competition in its industry, resulting from a very large international boat motor manufacturer that appears to be seriously considering entering the same customer market served by Rocket. Specifically, management is most worried about the sales revenue it might lose should this international competitor enter Rocket’s market. The chart below contains a description of Rocket’s top risk, an inherent risk assessment, three risk response alternatives, and a residual risk assessment for each response alternative.

Finally, Rocket’s management accounting team estimates that Rocket would need to spend $10,000,000 in product giveaways on each of its five biggest customers in order to convince them to sign long-term sales contracts with Rocket. Also, the team believes that Rocket would incur $8,500,000 in additional sales staff travel to complete the long-term contracts. Further, the team estimates that the new quality program would cost $15,000,000 in order to attain the higher level of performance quality necessary to set Rocket apart from its potential new competitor. Finally, Rocket forecasts that it would need to spend an additional $5,000,000 on advertising to sufficiently spread the word to customers regarding its significantly improved performance quality.

Required:

1. Calculate the net benefit for each of Rocket’s three risk response alternatives (A, B, and C) under consideration.

2. CONCEPTUAL CONNECTION Which risk response alternative should Rocket select? Explain your reasoning.

3. CONCEPTUAL CONNECTION Under what conditions would risk response alternative C be the preferred alternative?

4. Data visualization represents an important aspect of data analytics. Using any spreadsheet or other software tool, create a risk graph that plots the inherent risk point and residual risk point for risk response alternative A and risk response alternative B. Label each plotted point in your risk graph. Finally, draw two lines in your graph—one that connects the inherent risk point to residual risk A and the other that connects the inherent risk point to residual risk B.

Step by Step Answer:

Managerial Accounting The Cornerstone Of Business Decision Making

ISBN: 9780357715345

8th Edition

Authors: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger