Don Tidrick Manufacturing uses a job order cost system and applies overhead to production on the basis

Question:

Don Tidrick Manufacturing uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2002, Job No. 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials \($20,000\), direct labor \($12,000\), and manufacturing overhead \($21,000\). As of January 1, Job No. 49 had been completed at a cost of \($90,000\) and was part of finished goods inventory. There was a \($15,000\) balance in the Raw Materials inventory account. During the month of January, Don Tidrick Manufacturing began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for \($122,000\) and \($158,000\), respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of \($90,000\) on account. 2. Incurred factory labor costs of \($63,000\). Of this amount \($13,000\) related to employer payroll taxes. 3. Incurred manufacturing overhead costs as follows: indirect materials \($14,000;\) indirect labor \($15,000;\) depreciation expense \($19,000\), and various other manufacturing overhead costs on account \($23,000\). 4. Assigned direct materials and direct labor to jobs as follows.

Instructions

(a) Calculate the predetermined overhead rate for 2002, assuming Don Tidrick Manufacturing estimates total manufacturing overhead costs of \($1,050,000\), direct labor costs of \($700,000\), and direct labor hours of 20,000 for the year.

(b) Open job cost sheets for Jobs 50, 51, and 52. Enter the January' 1 balances on the job cost sheet for Job No. 50.

(c) Prepare the journal entries to record the purchase of raw materials, the factor) labor costs incurred, and the manufacturing overhead costs incurred during the month of January.

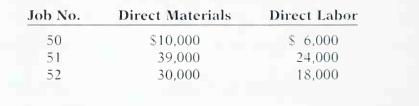

(d) Prepare the journal entries to record the assignment of direct materials, direct labor, and manufacturing overhead costs to production. In assigning manufacturing oxer- head costs, use the overhead rate calculated in (a). Post all costs to the job cost sheets as necessary.

(e) Total the job cost sheets for any) job(s) completed during the month. Prepare the journal entry (or entries) to record the completion of any job(s) during the month.

(f) Prepare the journal entry (or entries) to record the sale of any job(s) during the month.

(g) What is the balance in the Finished Goods Inventor) account at the end of the month?

What does this balance consist of?

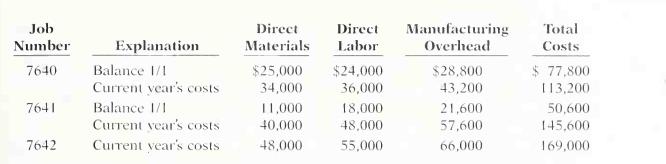

What is the amount oi over- or underapplied overhead for the month? How would this be reported on the financial statements for the month of January For the year ended December 3 1, 2002, the job cost sheets of Chicago Company contained the following data.

Other data:

1. Raw materials inventory totaled \($15,000\) on January 1. During the year, \($140,000\) ol raw materials were purchased on account.

2. Finished goods on January 1 consisted of Job No. 7638 for \($87,000\) and Job No. 7639 for \($92,000\).

3. Job No. 7640 and Job No. 7641 were completed during the year.

4. Jobs No. 7638, 7639, and 7641 were sold on account for \($530,000\).

5. Manufacturing overhead incurred on account totaled \($115,000\).

6. Other manufacturing overhead consisted of indirect materials \($14,000\), indirect labor \($20,000\), and depreciation on factory machinery \($8,000\).

Instructions

(a) Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Hint: Use a single T account for Work in Process Inventory Calculate each of the following, then post each to the T account: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs.

(b) Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold.

(c) Determine the gross profit to be reported for 2002.

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9780471413653

2nd Canadian Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly