Petty Plastics, Inc. manufactures two plastic thermos containers at its plastic molding facility in Elm, Washington. Its

Question:

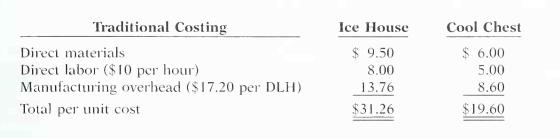

Petty Plastics, Inc. manufactures two plastic thermos containers at its plastic molding facility in Elm, Washington. Its large container, called the Ice House, has a volume of 5 gallons, side carrying handles, a snap-down lid, and a side drain and plug. Its smaller container, called the Cool Chest, has a volume of 2 gallons, an over-the-top carrying handle which is part of a tilting lid, and a removable shelf. Both containers and

their parts are made entirely of hard-molded plastic. The Ice House sells for \($35\) and the

Cool Chest sells for \($24\). The production costs computed per unit under traditional costing for each model in 2002 were as follows.

In 2002, Petty Plastics manufactured 50,000 units of the Ice House and 20,000 units

of the Cool Chest. The overhead rate of \($17.20\) per direct labor hour was determined by

dividing total expected manufacturing overhead of \($860,000\) by the total direct labor hours

(50,000) for the 2 models.

Under traditional costing, the gross profit on the two containers was: Ice House $3.74

or (\($35\) - $31.26), and Cool Chest \($4.40\) or (\($24\) - $19.60). The gross margin rates on

cost are: Ice House 12% or (\($3.74\) h- $31.26), and Cool Chest 22% or (\($4.40\) 4- $19.60).

Because Petty can earn a gross margin rate on the Cool Chest that is nearly twice as great

as that earned on the Ice House, with less investment in inventory and labor costs, its management is urging its sales staff to put its efforts into selling the Cool Chest over the

Ice House.

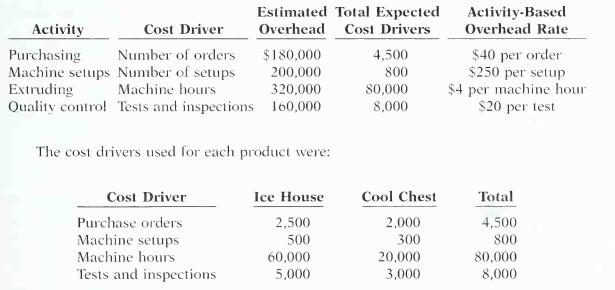

Before finalizing its decision, management asks the controller Dinna Martinez to prepare a product costing analysis using activity-based costing (ABC). Martinez accumulates

the following information about overhead for the year ended December 31, 2002.

Instructions

(a) Assign the total 2002 manufacturing overhead costs to the two products using activity based costing (ABC).

(b) What was the cost per unit and gross profit of each model using ABC costing?

(c) Are management's future plans for the two models sound?

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9780471413653

2nd Canadian Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly