Presented here are liability items for OBrian Inc. at December 31, 2025. Prepare the liabilities section of

Question:

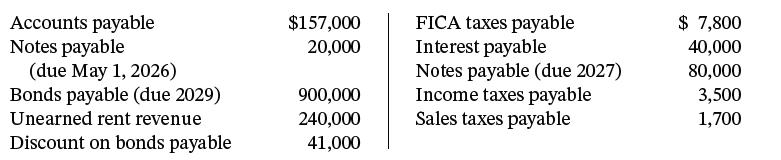

Presented here are liability items for O’Brian Inc. at December 31, 2025. Prepare the liabilities section of O’Brian’s balance sheet.

Transcribed Image Text:

Accounts payable Notes payable (due May 1, 2026) Bonds payable (due 2029) Unearned rent revenue Discount on bonds payable $157,000 20,000 900,000 240,000 41,000 FICA taxes payable Interest payable Notes payable (due 2027) Income taxes payable Sales taxes payable $ 7,800 40,000 80,000 3,500 1,700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

Current liabilities Notes payable due May 1 2026 Accounts payable Unearned rent revenue OBRIAN ...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9781119791058

8th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

Question Posted:

Students also viewed these Business questions

-

Presented here are liability items for O'Brian Inc. at December 31, 2019. Prepare the liabilities section of O'Brian's balance sheet. Accounts payable Notes payable 157,000 FICA taxes payable 20,000...

-

Presented here are liability items for Sheely Inc. at December 31, 2010. Prepare the liabilities section of Sheelys balancesheet. Accounts payable Bank note payable $155,000 Employee bencfits payable...

-

Presented here are liability items for Desmond Inc. at December 31, 2014. Pre-pare the liabilities section of Desmonds balancesheet. 7,800 40,000 80,000 3,500 1,700 Accounts payable Notes payable...

-

A childs grandparents purchase a $10,000 bond fund that matures in 18 years to be used for her college education. The bond fund pays 4% interest compounded semiannually. How much will the bond fund...

-

A partnership has the following balance sheet just before final liquidation is to begin: Liquidation expenses are estimated to be $12,000. The other assets are sold for $40,000. What distribution can...

-

Waiting times to receive food after placing an order at the local Subway sandwich shop follow an exponential distribution with a mean of 60 seconds. Calculate the probability a customer waits: a....

-

Why, in your opinion, does decision making include thoughts and feelings? Name some ways that feelings can help effective decision making. Name some ways that feelings can hinder effective decision...

-

According to HowtoAdvice.com, the average price charged to a customer to have a 12 by 18 wall-to-wall carpet shampoo cleaned is about $50. Suppose that a start-up carpet-cleaning company believes...

-

The following financial statements and additional information are reported. 2018 IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 Assets Cash $ 72,500 Accounts receivable, net...

-

C.S. Lewis Company had the following transactions involving notes payable. July 1, 2025 Borrows $50,000 from First National Bank by signing a 9-month, 8% note. Nov. 1, 2025 Borrows $60,000 from Lyon...

-

The balance sheet for Gelher Company reports the following information on July 1, 2025. Gelher decides to redeem these bonds at 102 after paying annual interest. Prepare the journal entry to record...

-

Strong Ltd. acquired 3,200 Equity Shares of Weak Ltd. on December 31, 2015. The summarised Balance Sheet of the two companies as on the date are given below: You are supplied with the following...

-

Alvarado Company produces a product that requires 5 standard direct labor hours per unit at a standard hourly rate of $12.00 per hour. If 5,700 units used 29,400 hours at an hourly rate of $11.40 per...

-

7. (30 points) You are a teaching assistant (TA) for a new course in the department and you wish to measure the amount of time that students spend engaging with the online resources. Using the Canvas...

-

Mod Clothiers makes women's clothes. It costs $28,000 to produce 5,000 pairs of polka-dot polyester pants. They have been unable to sell the pants at their usual price of $50.00. The company is...

-

In a mid-sized manufacturing company, the annual financial statements were prepared for audit by an external auditing firm. The company\'s finance team had diligently compiled the financial data, and...

-

Explain the meaning of the SMART acronym. In 100-200 words, define what the words "goal" and "success" mean to you. Summarize your thoughts on whether or not the SMART model can help you become a...

-

Owens has been successful with their student newspaper and would like to expand their publication base by creating a small, yet distinctive, magazine. This magazine will be available through...

-

The cash records of Holly Company show the following four situations. 1. The June 30 bank reconciliation indicated that deposits in transit total $720. During July, the general ledger account Cash...

-

The financial statements of Apple Inc. are presented in Appendix A. Instructions Answer the following questions. (a) What was the amount of net cash provided by operating activities for the year...

-

Walt Jax, the owner-president of Computer Services Company, is unfamiliar with the statement of cash flows that you, as his accountant, prepared. He asks for further explanation. Instructions Write...

-

On June 30, Flores Corporation discontinued its operations in Mexico. On September 1, Flores disposed of the Mexico facility at a pretax loss of $640,000. The applicable tax rate is 25%. Show the...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

-

Regarding research and experimental expenditures, which of the following are not qualified expenditures? 3 a. costs of ordinary testing of materials b. costs to develop a plant process c. costs of...

-

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting...

Study smarter with the SolutionInn App