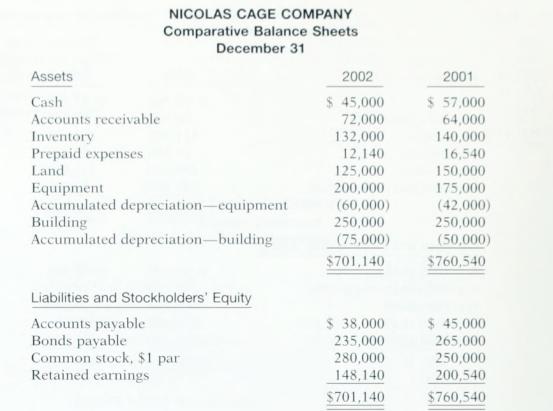

Presented on page 538 are the comparative balance sheets for Nicolas Cage Company at December 31. Additional

Question:

Presented on page 538 are the comparative balance sheets for Nicolas Cage Company at December 31.

Additional information: 1. Operating expenses include depreciation expense of \($70,000\) and charges from pre- paid expenses of \($4,400\). 2. Land was sold for cash at cost. 3. Cash dividends of \($79,290\) were paid. 4. Net income for 2002 was \($26,890\). 5. Equipment was purchased for \($65,000\) cash. In addition, equipment costing \($40,000\) with a book value of \($13,000\) was sold for \($14,000\) cash. 6. Bonds were converted at face value by issuing 30,000 shares of \($1\) par value common stock. 7. Net sales in 2002 were $367,000.

Instructions

(a) Prepare a statement of cash flows for 2002 using the indirect method.

(b) Compute the following cash-basis ratios for 2002. (1) Current cash debt coverage ratio. (2) Cash return on sales ratio. (3) Cash debt coverage ratio. (4) Free cash flow.

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9780471413653

2nd Canadian Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly