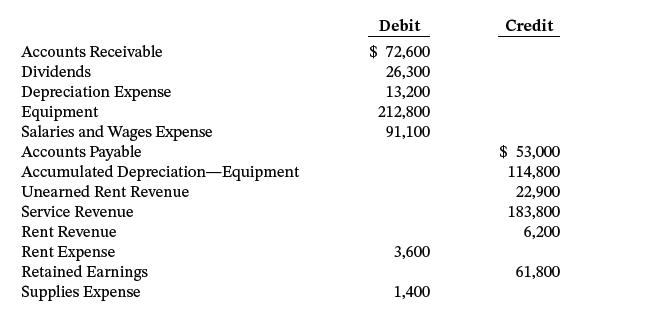

Selected year-end account balances from the adjusted trial balance as of December 31, 2025, for Tippy Corporation

Question:

Selected year-end account balances from the adjusted trial balance as of December 31, 2025, for Tippy Corporation is provided below.

Instructionsa. Prepare closing entries.b. Determine the post-closing balance in Retained Earnings.

Transcribed Image Text:

Accounts Receivable Dividends Depreciation Expense Equipment Salaries and Wages Expense Accounts Payable Accumulated Depreciation-Equipment Unearned Rent Revenue Service Revenue Rent Revenue Rent Expense Retained Earnings Supplies Expense Debit $ 72,600 26,300 13,200 212,800 91,100 3,600 1,400 Credit $ 53,000 114,800 22,900 183,800 6,200 61,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

a b Date Dec 31 Account Titles Service Revenue Rent Revenue Inco...View the full answer

Answered By

Ayush Jain

Subjects in which i am expert:

Computer Science :All subjects (Eg. Networking,Database ,Operating System,Information Security,)

Programming : C. C++, Python, Java, Machine Learning,Php

Android App Development, Xamarin, VS app development

Essay Writing

Research Paper

History, Management Subjects

Mathematics :Till Graduate Level

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9781119791058

8th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Selected year-end account balances from the adjusted trial balance as of December 31, 2022, for Tippy Corporation is provided below. Instructions a. Prepare closing entries b. Determine the...

-

Selected year-end account balances from the adjusted trial balance as of December 31, 2017, for Pronghorn Corp is provided below. Prepare Closing Entries Determine the post-closing balance in...

-

Q1. The following transactions occurred during Year 2, the second year of business for Nancy Nanny Child Care. Record each transaction in proper journal entry format below using debits and credits....

-

You work for a gas turbine design company and have a client who has a fairly loose specification for a gas turbine engine. You are required to design an aviation gas turbine to power the aircraft...

-

What are the two fund types within the proprietary funds? What types of events does each report?

-

Pennsylvania Refining Company is studying the relationship between the pump price of gasoline and the number of gallons sold. For a sample of 20 stations last Tuesday, the correlation was .78. At the...

-

Define change. (p. 249)

-

You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax Cash Flow 0...

-

The following is excluded from the taxable income of the recipient under a specific statutory exclusion of the Internal Revenue Code: A. The entire $6,000 reimbursement of child care expenses by an...

-

The ledger of Armour Lake Lumber Supply on July 31, 2025, includes the selected accounts below before adjusting entries have been prepared. An analysis of the companys accounts shows the following.1....

-

What are the characteristics of a critical audit matter?

-

Most supermarkets across the United States have invested heavily in optical scanner systems to expedite customer checkout, increase checkout productivity, and improve product accountability. These...

-

FA II: Assignment 1 - COGS & Bank Reconciliation 1. The following data pertains to Home Office Company for the year ended December 31, 2020: Sales (25% were cash sales) during the year Cost of goods...

-

Bramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Jan. 15 20 Feb. 10 15 Made Bramble credit card sales totaling...

-

11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the...

-

Karak Company produces Product (A) for only domestic distribution since year 2017. In 2019, a similar product to Karak Company has come onto the market by another competitor. Karak Company is keen to...

-

1. Purchase equipment in exchange for cash of $20,400. 2. Provide services to customers and receive cash of $4,900. 3. Pay the current month's rent of $1,000. 4. Purchase office supplies on account...

-

Last year Cramer Sales sold 190 units @ $340 each. Cash selling and administrative expenses were $15,000. The following information is also available: Beginning inventory 30 units...

-

Grace is training to be an airplane pilot and must complete five days of flying training in October with at least one day of rest between trainings. How many ways can Grace schedule her flying...

-

During 2012, Newberry Company entered into the following transactions.1. Purchased equipment for $286,176 cash.2. Issued common stock to investors for $137,590 cash.3. Purchased inventory of $68,480...

-

For each of the following accounts, indicate the effect of a debit or a credit on the account and the normal balance. (a) Accounts Payable. (b) Advertising Expense. (c) Service Revenue. (d) Accounts...

-

Transactions for Marlin Company for the month of June are presented below. Identify the accounts to be debited and credited for each transaction. June 1 Issues common stock to investors in exchange...

-

Al preparar el estado de resultados pro forma, cules de las siguientes partidas se deducen de las utilidades brutas para llegar a las ganancias despus de impuestos? Pregunta de seleccin mltiple....

-

Lawson Inc. is expanding its manufacturing plant, which requires an investment of $4 million in new equipment and plant modifications. Lawson's sales are expected to increase by $3 million per year...

-

20 On January 1, Year 1, X Company purchased equipment for $80,000. The company estimates that the equipment will have a useful life of 10 years and a residual value of $5,000. X Company depreciates...

Study smarter with the SolutionInn App