Stellar Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles,

Question:

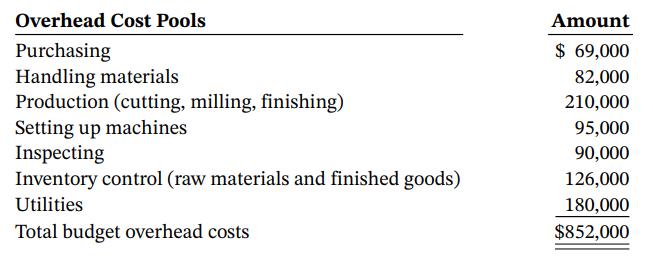

Stellar Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, handrails) permit installation of stairways of varying lengths and widths. All are made of white oak wood. The company’s budgeted manufacturing overhead costs for 2022 are as follows:

For the past four years, Stellar Stairs has been charging overhead to products on the basis of machine hours. For 2022, it has budgeted 100,000 machine hours.

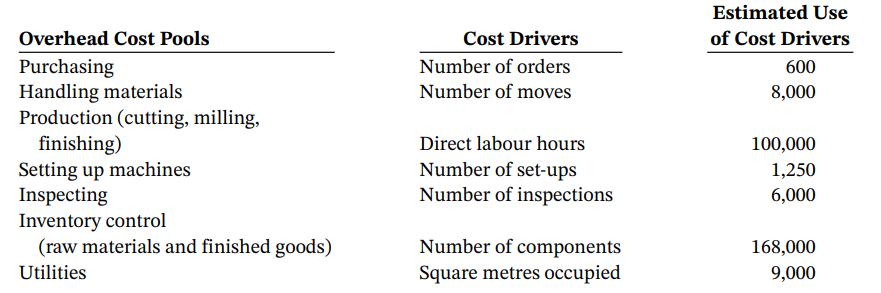

Heather Fujar, owner-manager of Stellar Stairs, recently directed her accountant, Kiko Nishikawa, to implement the activity-based costing system that she has repeatedly proposed. At Heather’s request, Kiko and the production foreperson identify the following cost drivers and their usage for the previously budgeted overhead cost pools.

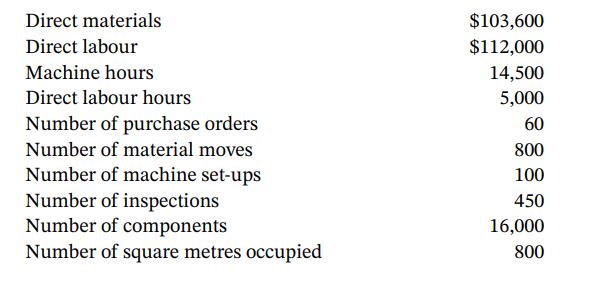

Jason Dion, sales manager, has received an order for 280 stairways from Community Builders Inc., a large housing development contractor. At Jason’s request, Kiko prepares cost estimates for producing components for 280 stairways so Jason can submit a contract price per stairway to Community Builders. She accumulates the following data for the production of 280 stairways:

Instructions

a. Calculate the predetermined overhead rate using traditional costing with machine hours as the basis.

b. What is the manufacturing cost per stairway under traditional costing?

c. What is the manufacturing cost per stairway under the proposed activity-based costing?

d. Which of the two costing systems is preferable in pricing decisions and why?

Step by Step Answer:

Accounting Tools For Business Decision Making

ISBN: 9780470377857

3rd Edition

Authors: Paul D. Kimmel