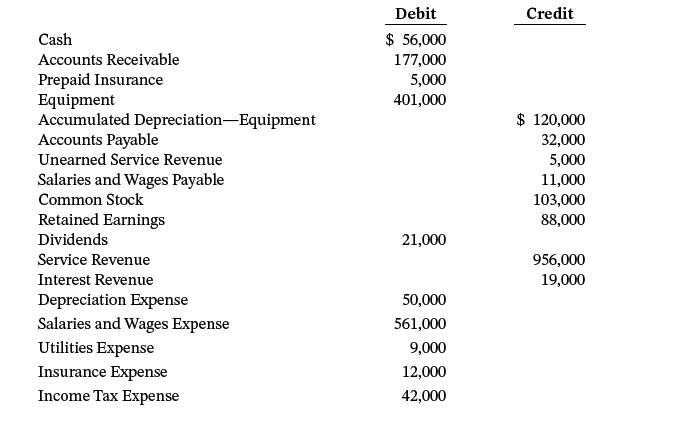

The adjusted trial balance for Laurel Developments as of March 31, 2025, is as follows. Instructions a.

Question:

The adjusted trial balance for Laurel Developments as of March 31, 2025, is as follows.

Instructionsa. Prepare the closing entries.b. Determine Laurel Developments’ ending retained earnings balance as of March 31, 2025.

Transcribed Image Text:

Cash Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common Stock Retained Earnings Dividends Service Revenue Interest Revenue Depreciation Expense Salaries and Wages Expense Utilities Expense Insurance Expense Income Tax Expense Debit $ 56,000 177,000 5,000 401,000 21,000 50,000 561,000 9,000 12,000 42,000 Credit $ 120,000 32,000 5,000 11,000 103,000 88,000 956,000 19,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

a b Mar 31 31 31 Service Revenue Interest Revenue Income Summary Income Summa...View the full answer

Answered By

RADHIKA MEENAKAR

I am a qualified indian Company Secretary along with Masters in finance with over 6 plus years of professional experience. Apart from this i am a certified accounts and finance tutor on many online platforms.

My Linkedin profile link is here https://www.linkedin.com/in/radhika-meenakar-88b9808a/

5.00+

12+ Reviews

22+ Question Solved

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9781119791058

8th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Read ALL instructions before getting started! ABC Corporation is a new company that buys and sells office supplies. Business began on January 1, 2012. Given on the first two tabs are ABC's 12/31/12...

-

The adjusted trial balance for Anara Co. as of December 31, 2016, follows. The December 31, 2015, credit balance of the Retained Earnings account was $62,800. Anara Company is required to make an...

-

The adjusted trial balance of Business Reduction Systems at March 31, 2016, follows: Requirements 1. Journalize the required closing entries at March 31, 2016. 2. Set up T-accounts for Income...

-

What did Frederick Taylor, the proponent of scientific management, advocate for to achieve efficiency in manufacturing?

-

Why are budgetary entries recorded in the individual funds of a state or local government?

-

Emily Smith decides to buy a fuel-efficient used car. Here are several vehicles she is considering, with the estimated cost to purchase and the age of the vehicle. a. Plot these data on a scatter...

-

Identify the difference between incremental and transformational change. (p. 249)

-

Parvis Bank and Trust Co. has calculated its daily average deposits and vault cash holdings for the most recent two-week computation period as follows: Net transaction deposits.......... = $...

-

Kenosha Winter Services is a small, family-owned snow-removal business. For its services, the company has always charged a flat fee per hundred square metres of snow removal. The current fee is...

-

Merle Hawkins, the president of Pathway Company, is pleased. Pathway substantially increased its net income in 2025 while keeping its unit inventory relatively the same. Jon Dietz, chief accountant,...

-

On December 31, 2025, Waters Company prepared an income statement and balance sheet, but failed to take into account three adjusting entries. The balance sheet showed total assets $150,000, total...

-

In Problems 9 14, find the domain of each function. f(x) = x + 1 x 2-4

-

Solve (c) 8 WI n=1 5 cos n N5

-

- Pierce Company reported net income of $160,000 with income tax expense of $19,000 for 2020. Depreciation recorded on buildings and equipment amounted to $80,000 for the year. Balances of the...

-

ABC Company had the following results as of 12/31/2020: ABC's hurdle rate is 10% CONTROLLABLE REVENUE CONTROLLABLE COST CONTROLLABLE ASSETS CONTROLLABLE INCOME 21. What is the division's margin? A....

-

A gray kangaroo can bound across a flat stretch of ground with each jump carrying it 10 m from the takeoff point. If the kangaroo leaves the ground at a 20 angle, what are its (a) takeoff speed and...

-

Since 1900, many new theories in physics have changed the way that physicists view the world. Create a presentation that will explain to middle school students why Quantum Mechanics is important, how...

-

During December, the capital budget indicates a $280,000 purchase of equipment. The ending November cash balance is budgeted to be $40,000. Cash receipts are $840,000, and cash disbursements are...

-

Burberrys competitive advantage is through its differentiation strategy. What risk should Burberry remain aware of?

-

(a) When entering a transaction in the journal, should the debit or credit be written first? (b) Which should be indented, the debit or the credit?

-

(a) Should accounting transaction debits and credits be recorded directly in the ledger accounts? (b) What are the advantages of first recording transactions in the journal and then posting to the...

-

Journalize these accounting transactions. (a) Stockholders invested $12,000 in the business in exchange for common stock. (b) Insurance of $800 is paid for the year. (c) Supplies of $1,800 are...

-

A government bond matures in 30 years, makes semi-annual coupon payments of 6.0% ($120 per year) and offers a yield of 3.7% annually compounded. Assume face value is $1,000. Three years later the...

-

Your objective is: 1. Carry out a life insurance needs analysis, for each one of them (show your calculations) [30 Marks] 2. Refer to the case and the insurance plan quotes. Would you recommend...

-

TufStuff, Incorporated, sells a wide range of drums, bins, boxes, and other containers that are used in the chemical industry. One of the company s products is a heavy - duty corrosion - resistant...

Study smarter with the SolutionInn App