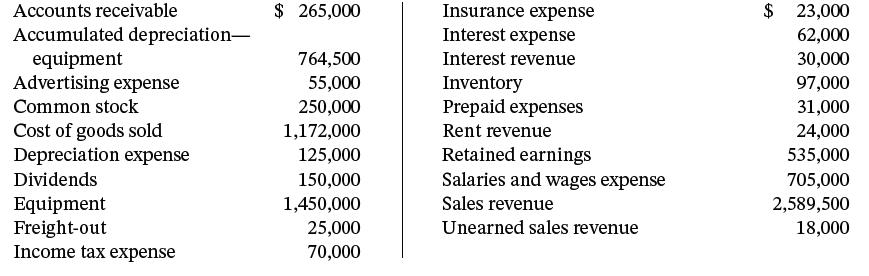

The following selected accounts from Orlando Corporations general ledger are for the year ended December 31, 2025.

Question:

The following selected accounts from Orlando Corporation’s general ledger are for the year ended December 31, 2025.

InstructionsPrepare a multiple-step income statement.

Transcribed Image Text:

Accounts receivable Accumulated depreciation- equipment Advertising expense Common stock Cost of goods sold Depreciation expense Dividends Equipment Freight-out Income tax expense $ 265,000 764,500 55,000 250,000 1,172,000 125,000 150,000 1,450,000 25,000 70,000 Insurance expense Interest expense Interest revenue Inventory Prepaid expenses Rent revenue Retained earnings Salaries and wages expense Sales revenue Unearned sales revenue $ 23,000 62,000 30,000 97,000 31,000 24,000 535,000 705,000 2,589,500 18,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (15 reviews)

Sales revenue Cost of goods sold Gross profit Operating expenses Sa...View the full answer

Answered By

Sandip Agarwal

I have an experience of over 4 years in tutoring. I have solved more than 2100 assignments and I am comfortable with all levels of writing and referencing.

4.70+

19+ Reviews

29+ Question Solved

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9781119791058

8th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

Question Posted:

Students also viewed these Business questions

-

The following selected accounts are from Dupré Corp.'s general ledger: Additional information: July 31 Equipment with a cost of $70,000 was purchased for cash. Sept. 2 Equipment with a cost of...

-

The following selected accounts from the Blue Door Corporation's general ledger are presented below for the year ended December 31, 2018: Accounts receivable...

-

K Solve the equation on the interval 0s0 <2. 12 sin 0-3=0 What are the solutions in the interval 0 0 <2x? Select the correct choice and fill in any answer boxes in your choice below. OA. The solution...

-

Identify the implied strategies that correspond with the Department of Veterans Affairs Healthcare System High Matrix Score on SWOT quadran that they might look like at your HSO. Also explain why...

-

What costs cause a governmental fund to report an expenditure?

-

Bradford Electric Illuminating Company is studying the relationship between kilowatt-hours (thousands) used and the number of rooms in a private single-family residence. A random sample of 10 homes...

-

Learn how HR can foster effective change. (p. 249)

-

The following information relates to Shea Inc.'s accounts receivable for the 2017 fiscal year: 1. An aging schedule of the accounts receivable as at December 31, 2017, is as follows: *The $2,740...

-

The following are selected statement of financial position accounts of Cheyenne Ltd. at December 31, 2019 and 2020, and the increases or decreases in each account from 2019 to 2020. Also presented is...

-

On July 1, 2025, Ling Co. pays $12,400 to Marsh Insurance Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. For Ling Co., journalize and post the entry on July...

-

Lopez Co. had three major business transactions during 2025. a. Reported at its fair value of $260,000 merchandise inventory with a cost of $208,000. b. The president of Lopez Co., Victor Lopez,...

-

Suppose that a random sample is to be taken from a normal distribution for which the value of the mean is unknown and the standard deviation is 2, and the prior distribution of is a normal...

-

Solve the following linear system by Gaussian elimination with back-substitution without introducing fractions in your row-reduction. If there is no solution, explain why. -3x+8y + 82 = -8 -2x+ y -...

-

Introduction Some predictions are a slam dunk. Retail will continue to be driven by technology. Science fiction is coming to life in the form of robotics and virtual reality. And the Internet will...

-

Oswego Clay Pipe Company provides services of $ 5 0 , 0 0 0 to Southeast Water District # 4 5 on April 1 2 of the current year with terms 1 / 1 5 , n / 6 0 . What would Oswego record on April 1 2 ?...

-

Assume the following excerpts from a company's balance sheet: Property, plant, and equipment Beginning Balance $3,500,000 Ending Balance $3,700,000 $1,100,000 $800,000 Long-term investments During...

-

On January 1, 2021, Bonita Corp. had472,000shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account. February 1 Issued 125,000shares...

-

a. Use the spreadsheet to calculate as many of the company's Profitability, Turnover-Control, and Leverage and Liquidity ratios as you can for these years (see Table 2.5 in text for a list of...

-

In a system with light damping (c < cc), the period of vibration is commonly defined as the time interval d = 2/d corresponding to two successive points where the displacement-time curve touches one...

-

Indicate in which financial statement each of the following adjusted trial balance yet account would be presented. Service Revenue ....................... Accounts Receivable Notes Payable...

-

Selected accounts of Villa Company are shown here. Instructions After analyzing the accounts, journalize (a) The July transactions (b) The adjusting entries that were made on July 31. Supplies...

-

The adjusted trial balance for Ryan Company is given in E4-21. Instructions Prepare the income and retained earnings statements for the year and the classified balance sheet at August 31.

-

1. (A nice inharitage) Suppose $1 were invested in 1776 at 3.3% interest compounded yearly a) Approximatelly how much would that investment be worth today: $1,000, $10,000, $100,000, or $1,000,000?...

-

Why Should not the government subsidize home buyers who make less than $120K per year. please explain this statement

-

Entries for equity investments: 20%50% ownership On January 6, 20Y8, Bulldog Co. purchased 25% of the outstanding common stock of $159,000. Gator Co. paid total dividends of $20,700 to all...

Study smarter with the SolutionInn App