The T-accounts for Equipment and the related Accumulated DepreciationEquipment for Goldstone Company at the end of 2025

Question:

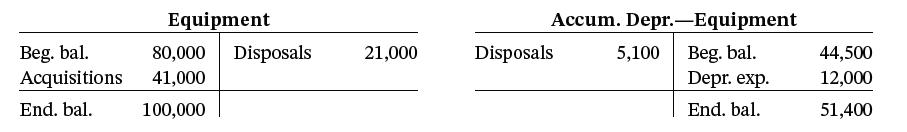

The T-accounts for Equipment and the related Accumulated Depreciation—Equipment for Goldstone Company at the end of 2025 are shown here.

In addition, Goldstone’s income statement reported a loss on the disposal of plant assets of $3,500. What amount was reported on the statement of cash flows as “cash flow from sale of equipment”?

Transcribed Image Text:

Beg. bal. Acquisitions End. bal. Equipment 80,000 Disposals 41,000 100,000 21,000 Accum. Depr.-Equipment Beg. bal. Depr. exp. End. bal. Disposals 5,100 44,500 12,000 51,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

Original cost of equipment sold Less Accumulated deprec...View the full answer

Answered By

Gilbert Chesire

I am a diligent writer who understands the writing conventions used in the industry and with the expertise to produce high quality papers at all times. I love to write plagiarism free work with which the grammar flows perfectly. I write both academics and articles with a lot of enthusiasm. I am always determined to put the interests of my customers before mine so as to build a cohesive environment where we can benefit from each other. I value all my clients and I pay them back by delivering the quality of work they yearn to get.

4.80+

14+ Reviews

49+ Question Solved

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9781119791058

8th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell

Question Posted:

Related Video

In order to determine the amount of cash created by operating operations, the indirect technique for preparing the statement of cash flows entails adjusting net income with changes in balance sheet.

Students also viewed these Business questions

-

The T-accounts for Equipment and the related Accumulated Depreciation Equip. for Coldsmith Company at the end of 2014 are shown here. In addition, Coldsmith Companys income statement reported a loss...

-

The T-accounts for Equipment and the related Accumulated Depreciation- Equipment for Luo Company at the end of 2019 are shown here. In addition, Luo's income statement reported a loss on the disposal...

-

The T-accounts for Equipment and the related Accumulated Depreciation Equipment for Ada Company at the end of 2014 are shown here. In addition, Ada Companys income statement reported a loss on...

-

Carrie Carson: Carrie is a 60-year-old tai chi instructor living in Santa Fe, New Mexico. For many years, she practiced in Hollywood, and because of an acting background, she developed a clientele...

-

Butler Manufacturing Corporation planned to raise capital for a plant expansion by borrowing from banks and making several stock offerings. Butler engaged Meng, CPA, to audit its financial...

-

Suppose that a computer chip company has just shipped 10,000 computer chips to a computer company. Unfortunately, 50 of the chips are defective. (a) Compute the probability that two randomly selected...

-

Although immigrants to the United States come from all over the world, when many people think of immigrants, they think of Hispanics. Do Hispanics have different attitudes toward immigration than...

-

Should all companies consider reducing their sales forces in favor of telemarketing? Discuss the pros and cons of this action. Many companies are realizing the efficiency of telemarketing in the face...

-

Robert owns a small business. This year, he paid his employees $42,213. Insurance and licensing expenses cost $19,000. The cost of materials was $29,549. Robert has $190,000 invested in equipment for...

-

Pineda State College, a public college, receives notification prior to the start of the fiscal year that it will receive $1,400,000 in appropriations from the state. The appropriations are...

-

Sosa Company reported net income of $190,000 for 2025. Sosa also reported depreciation expense of $35,000 and a loss of $5,000 on the disposal of plant assets. The comparative balance sheets show an...

-

The following three accounts appear in the general ledger of Beiber Corp. during 2025. Instructions From the postings in the accounts, indicate how the information is reported by preparing a partial...

-

What are some things a bank can do to increase its net interest margin?

-

For this online discussion, we will explore the relevance of various management styles in the context of your respective organizations. Your task is to review different management styles and propose...

-

Is a t-Distribution Appropriate? A sample with size n = 10 has x = 508.5, and s = 21.5. The dotplot for this sample is given below. 0000 00 500 510 520 530 540 550 560 570 Indicate whether or not it...

-

Interpret the results. Write a statement to summarize your conclusion. Is a relationship present? Do we accept or reject the null hypothesis? Are the two variables related? Why or why not?

-

Case study information Australian Renewable Energy Hub Source: https://research.csiro.au/hyresource/australian-renewable-energy-hub/ April 20th, 2023 The Australian Renewable Energy Hub (AREH) will...

-

Listening is a crucial leadership skill that is essential for building effective relationships and solving problems. Write a paper that explores the importance of listening as a leadership skill,...

-

1. In probability, a(n) _________ is any process that can be repeated in which the results are uncertain. 2. A(n) ________ is any collection of outcomes from a probability experiment.

-

What is master production scheduling and how is it done?

-

In 2012, Tim Hortons Inc. reported net sales of $2,226 million, profit of $403 million, and average total assets of $2,244 million. In 2011, its net sales were $2,012 million, profit was $383...

-

What are land improvements? Should the cost of clearing and grading land be recorded as a land improvement or not? Why or why not?

-

Explain the difference between an operating lease and a finance lease. What accounts are recorded on the financial statements for each type of lease?

-

Mediocre Company has sales of $120,000, fixed expenses of $24,000, and a net income of $12,000. If sales rose 10%, the new net income would be: Question 18 options: $16,800 $36,000 $13,200 $15,600

-

1. Why might managers of small restaurants decide not to adopt the standard work hour approach to controlling labour cost? (minimum 150 words )

-

Which statement is true regarding the U.S. GAAP impairment test for limited life intangibles? A. U.S. GAAP impairment is likely to be greater than IFRS impairment. B. The impairment test for limited...

Study smarter with the SolutionInn App