Eastern Educational Services is considering the following proposal to sell its teaching machine and purchase a new,

Question:

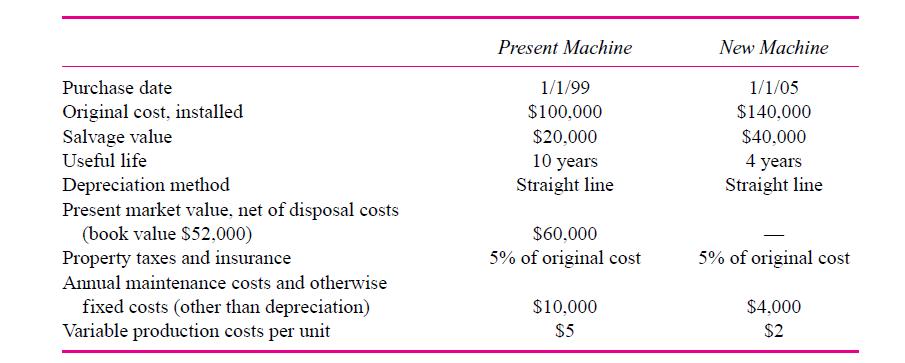

Eastern Educational Services is considering the following proposal to sell its teaching machine and purchase a new, improved machine. The following data are presented by the department head:

Additional information:

1. The company expects to produce 10,000 units a year selling at $10 each with either machine.

2. The company’s tax rate is 40 percent on all income and expenses.

3. All annual income and expenses are assumed to occur at year-end.

4. The company’s cost of capital is 12 percent after taxes.

5. The firm is located in a European country where capital gains are taxed at 40 percent.

Capital gains are computed as the difference between the sales price and book value (original cost less accumulated depreciation).

Required:

a. Present a financial analysis in which you evaluate the proposal. A clear presentation is important.

b. Would you be more likely, less likely, or equally likely to recommend the purchase of the new machine given the following:

(i) The company’s discount rate is increased.

(ii) The new machine can be depreciated by the double-declining-balance method.

Step by Step Answer:

Accounting For Decision Making And Control

ISBN: 9780078136726

7th Edition

Authors: Jerold Zimmerman