In a recent report, the Del Monte Foods Company reported three separate operating segments: consumer products (which

Question:

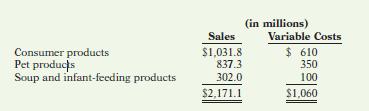

In a recent report, the Del Monte Foods Company reported three separate operating segments: consumer products (which includes a variety of canned foods including tuna, fruit, and vegetables); pet products (which includes pet food and snacks and veterinary products);

and soup and infant-feeding products (which includes soup, broth, and infant feeding and pureed products).

In its annual report, Del Monte uses absorption costing. As a result, information regarding the relative composition of its fixed and variable costs is not available. We have assumed that

$860.3 million of its total operating expenses of $1,920.3 million are fixed and have allocated the remaining variable costs across the three divisions. Sales data, along with assumed expense data, are provided on the next page.

Instructions

(a) Compute each segment’s contribution margin ratio and the sales mix.

(b) Using the information computed in part (a), compute the company’s break-even point in dollars, and then determine the amount of sales that would be generated by each division at the break-even point.

MANAGERIAL ACCOUNTING ON THE WEB

Step by Step Answer:

Accounting Tools For Business Decision Making

ISBN: 9780470534786

4th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso