Polk Company builds custom fishing lures for sporting goods stores. In its first year of operations, 2012,

Question:

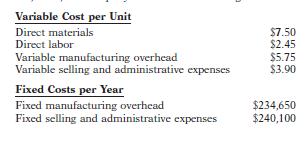

Polk Company builds custom fishing lures for sporting goods stores. In its first year of operations, 2012, the company incurred the following costs.

Polk Company sells the fishing lures for $25. During 2012, the company sold 80,000 lures and produced 95,000 lures.

Instructions

(a) Assuming the company uses variable costing, calculate Polk’s manufacturing cost per unit for 2012.

(b) Prepare a variable costing income statement for 2012.

(c) Assuming the company uses absorption costing, calculate Polk’s manufacturing cost per unit for 2012.

(d) Prepare an absorption costing income statement for 2012.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9780470534786

4th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted: