The following information is available for Oscar Corporation for the year ended December 31, 2012. Instructions Prepare

Question:

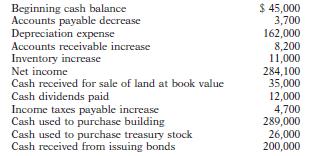

The following information is available for Oscar Corporation for the year ended December 31, 2012.

Instructions Prepare a statement of cash flows using the indirect method.

Transcribed Image Text:

Beginning cash balance Accounts payable decrease $ 45,000 3,700 Depreciation expense 162,000 Accounts receivable increase 8,200 Inventory increase 11,000 Net income 284,100 Cash received for sale of land at book value 35,000 Cash dividends paid 12,000 Income taxes payable increase 4,700 Cash used to purchase building 289,000 Cash used to purchase treasury stock Cash received from issuing bonds 26,000 200,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9780470534786

4th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted:

Students also viewed these Business questions

-

That is not what i asked. Please show the comprehensive income statement under the fair value method, and a comprehensive income statement under the equity method

-

Accounting for Inventories" Please respond to the following: As a Financial Accountant,determine the best type of income statement a retailer should use.Defend your suggestion. Analyze inventory...

-

Prepare a statement of cash flows using the indirect method. 1. Use the income statement and balance sheet to prepare a statement of cash flows using the indirect method. All answers must be entered...

-

Which is false? The Chinese government is reluctant to let the yuan appreciate against the US dollar because: Appreciation of the yuan would increase the price of real estate for young Chinese...

-

Consider Problem 2, Set 2.3d (Chapter 2). Suppose that any additional capacity of machines 1 and 2 can be acquired only by using overtime. What is the maximum cost per hour the company should be...

-

What is meant by LEARR in the context of governance codes? Discuss the various components that are referred to in the LEARR acronym and why they are important to a companys continuing operations.

-

Imagine that you designed a high-end line of clothing and accessories. Which factors should you consider when choosing retail partners? What type of retailer would you choose as a partner? Why?

-

Chocolates has observed the following overhead costs for the past 12 months: The results of the regression analysis are: TC = $8,781 + ($0:63 Ã Number of Boxes) a. Plot the data and the...

-

Suppose Columbia Sportswear Company had accounts receivable of $274,504,600 at January 1, 2017, and $220,465,900 at December 31, 2017. Assume sales revenue was $1,313,263,600 for the year 2017, What...

-

The three accounts shown below appear in the general ledger of Jurena Corp. during 2012. Instructions From the postings in the accounts, indicate how the information is reported on a statement of...

-

Classify each item as an operating, investing, or financing activity. Assume all items involve cash unless there is information to the contrary. (a) Purchase of equipment. (d) Depreciation. (b) Sale...

-

The biofuel startup that you consult for wants to use a pervaporation system to remove water from n-butanol using a cellulose 2.5 -acetate membrane in a perfectly mixed module. You have been asked to...

-

Among 450 randomly selected drivers in the 16 - 18 age bracket, 374 were in a car crash in the last year. If a driver in that age bracket is randomly selected, what is the approximate probability...

-

Construct a 90% confidence interval for the population standard deviation o at Bank A. Bank A 6.4 6.6 6.7 6.8 7.1 7.2 7.6 7.8 7.8 7.8

-

In 2002, after the accounting deceptions of the management of many multi-million dollar corporations (with Enron being the benchmark name of that time period), the Security and Exchange Commission...

-

1.Deduce the structure of a compound with molecular formula CsH100 that exhibits the following IR, H NMR, and 13C NMR spectra. Data from the mass spectrum are also provided. Mass Spec. Data relative...

-

Transcribed image text: Prots Caco.ch Part 2 Income Statement Med Earningstemet Tante Sheet For the event.com Competence ended The fram C an an dy wana A TO nede ANG ore.com wwwwww og for to...

-

Both Polaris and Arctic Cat sell motorized vehicles, and each of these companies has a different product mix. Required 1. Assume the following data are available for both companies. Compute each...

-

Create an appropriate display of the navel data collected in Exercise 25 of Section 3.1. Discuss any special properties of this distribution. Exercise 25 The navel ratio is defined to be a persons...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App