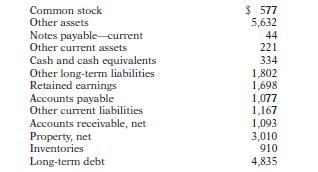

The following items are from the 2009 balance sheet of Kellogg Company. (All dollars are in millions.)

Question:

The following items are from the 2009 balance sheet of Kellogg Company. (All dollars are in millions.)

Instructions Prepare a classified balance sheet for Kellogg Company as of December 31, 2009.

Transcribed Image Text:

Common stock Other assets Notes payable-current Other current assets Cash and cash equivalents $ 577 5,632 44 221 334 Other long-term liabilities 1,802 Retained earnings 1,698 Accounts payable 1,077 Other current liabilities 1,167 Accounts receivable, net 1,093 Property, net 3,010 Inventories 910 Long-term debt 4,835

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Tools For Business Decision Making

ISBN: 9780470534786

4th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted:

Students also viewed these Business questions

-

The following items are from the 2009 balance sheet of Kellogg Company. (All dollars are in millions.) Common stock ....... $ 577 Other assets ......... 5,632 Notes payable-current ....... 44 Other...

-

HOMEY Electronics (HE) is one of the famous electronics businesses in the Kingdom of Bahrain. Over the past decade, HOMEY has emerged as a leading competitor in the industry, due to the exceptional...

-

Please see document attached.I need help with 6 question. Question 1) The company's complete annual report, including the notes to its financial statements, is available in the Investor Relations...

-

Zephre Company reported net income for the year of $56,000. Depreciation expense for the year was $12,000. During the year, accounts receivable increased by $4,000, inventory decreased by $6,000,...

-

1. Compare CP Rails initiatives to advance women with the recommended six-step program for the implementation of employment equity. 2. Review the list in Highlights in HRM 3.1 (retention strategies)....

-

Navel County Choppers, Inc., is experiencing rapid growth. The company expects dividends to grow at 18 percent per year for the next 11 years before leveling off at 4 percent into perpetuity. The...

-

4. What are the three categories of medium-term value drivers? Provide some examples of potential medium-term value drivers for a company that you are familiar with.

-

A thin metallic wire of thermal conductivity k, diameter D, and length 2L is annealed by passing an electrical current through the wire to induce a uniform volumetric heat generation q. The ambient...

-

Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours Standard Price or...

-

These items are taken from the financial statements of Tilley, Inc. Instructions Prepare an income statement, a retained earnings statement, and a classified balance sheet as of December 31, 2012....

-

You are provided with the following information for Merrell Enterprises, effective as of its April 30, 2012, year-end. Instructions (a) Prepare an income statement and a retained earnings statement...

-

The fugacity of a species in a mixture can have a peculiar dependence on composition at fixed temperature and pressure, especially if there is a change of phase with composition. Show this by...

-

Safeway, Inc., operated 1,739 stores as of January 3, 2009. The following data were taken from the company's annual report. All dollar amounts are in thousands. Required a. Compute Safeway's...

-

Rich French, the owner of Rich's Fishing Supplies, is surprised at the amount of actual inventory at the end of the year. He thought there should be more inventory on hand based on the amount of...

-

Carol Lapaz owned a small company that sold boating equipment. The equipment was expensive, and a perpetual system was maintained for control purposes. Even so, lost, damaged, and stolen merchandise...

-

The following footnote related to accounting for inventory was taken from the 2008 annual report of Wal-Mart, Inc. Inventories The Company values inventories at the lower of cost or market as...

-

Plot the magnitude and phase of the frequency response of normalized n-th order lowpass Butterworth filters.

-

On December 31, 2014, Turnball Associates owned the following securities, held as a long-term investment. The securities are not held for influence or control of the investee. On December 31, 2014,...

-

The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory (d) 500 (e) 300 (b)...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App