The University of Devonport consists of six faculties and an administration unit. Under the universitys management philosophy,

Question:

The University of Devonport consists of six faculties and an administration unit. Under the university’s management philosophy, each faculty is treated, as far as is reasonable, as an independent entity. Each faculty is responsible for its own budget and financial decision making.

A new course in the Faculty of Geography (FG) requires some input from a member of staff of the Faculty of Modern Languages (FML).

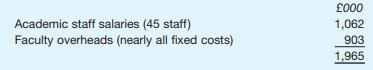

The two faculties are in dispute about the ‘price’ that FG should pay FML for each hour of the staff member’s time. FML argues that the hourly rate should be £97. This is based on the FML budget for this year, which in broad outline is as follows:

Each academic is expected to teach on average for 15 hours a week for 33 weeks a year.

FML wishes to charge FG an hourly rate which will cover the appropriate proportion of the member of staff’s salary plus a ‘fair’ share of the overheads plus 10 per cent for a small surplus.

FG is refusing to pay this rate. One of FG’s arguments is that it should not have to bear any other cost than the appropriate share of the salary. FG also argues that it could find a lecturer who works at the nearby University of Tavistock and is prepared to do the work for £25 an hour, as an additional, spare-time activity.

FML argues that it has deliberately staffed itself at a level which will enable it to cover FG’s requirements and that the price must therefore cover the costs.

The university’s Vice-Chancellor (its most senior manager) has been asked to resolve the dispute. You are the university’s finance manager.

Required:

Make notes in preparation for a meeting with the Vice-Chancellor, where you will discuss the problem with her. The Vice-Chancellor is a historian by background and is not familiar with financial matters. Your notes will therefore need to be expressed in language that an intelligent layperson can understand.

Your notes should deal both with the objectives of effective transfer prices and with the specifics of this case. You should raise any issues which you think might be relevant.

Step by Step Answer:

Management Accounting For Decision Makers

ISBN: 9780273731528

6th Edition

Authors: Dr Peter Atrill, Eddie McLaney