VideoPlus, Inc. manufactures two types of DVD players, a deluxe model and a standard model. The deluxe

Question:

VideoPlus, Inc. manufactures two types of DVD players, a deluxe model and a standard model. The deluxe model is a multi-format progressive-scan DVD player with networking capability, Dolby digital, and DTS decoder. The standard model’s primary feature is progressive-scan. Annual production is 50,000 units for the deluxe and 20,000 units for the standard.

Both products require 2 hours of direct labor for completion. Therefore, total annual direct labor hours are 140,000 [2 hrs. (20,000 50,000)]. Expected annual manufacturing overhead is $1,050,000. Thus, the predetermined overhead rate is $7.50 ($1,050,000

140,000) per direct labor hour. The direct materials cost per unit is $42 for the deluxe model and $11 for the standard model. The direct labor cost is $18 per unit for both the deluxe and the standard models.

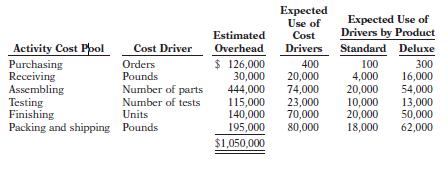

The company’s managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows.

Instructions

(a) Under traditional product costing, compute the total unit cost of both products.

Prepare a simple comparative schedule of the individual costs by product (similar to Illustration 17-10 on page 896).

(b) Under ABC, prepare a schedule showing the computations of the activity-based overhead rates (per cost driver).

(c) Prepare a schedule assigning each activity’s overhead cost pool to each product based on the use of cost drivers. (Include a computation of overhead cost per unit, rounding to the nearest cent.)

(d) Compute the total cost per unit for each product under ABC.

(e) Classify each of the activities as a value-added activity or a non–value-added activity.

(f) Comment on (1) the comparative overhead cost per unit for the two products under ABC, and (2) the comparative total costs per unit under traditional costing and ABC.

Step by Step Answer:

Accounting Tools For Business Decision Making

ISBN: 9780470534786

4th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso