Question: Annas Bakery plans to purchase a new oven for its store. The oven has an estimated useful life of four years. The estimated pretax cash

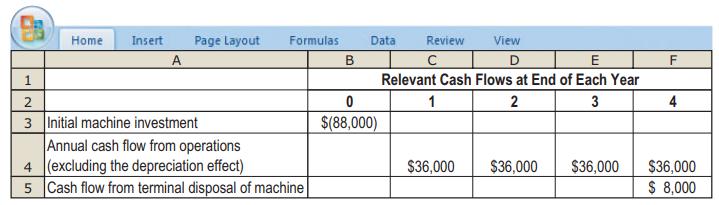

Anna’s Bakery plans to purchase a new oven for its store. The oven has an estimated useful life of four years. The estimated pretax cash flows for the oven are as shown in the table that follows, with no anticipated change in working capital. Anna’s Bakery has a 12% after-tax required rate of return and a 40% income tax rate. Assume depreciation is calculated on a straight-line basis for tax purposes using the initial oven investment and estimated terminal disposal value of the oven. Assume all cash flows occur at year-end except for initial investment amounts.

Required

1. Calculate (a) net present value, (b) payback period, and (c) internal rate of return.

2. Calculate accrual accounting rate of return based on net initial investment.

Step by Step Solution

3.21 Rating (156 Votes )

There are 3 Steps involved in it

a Net Present Value NPV The net present value NPV is a measure of the profitability of an investment which takes into account both the initial investm... View full answer

Get step-by-step solutions from verified subject matter experts