As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginning

Question:

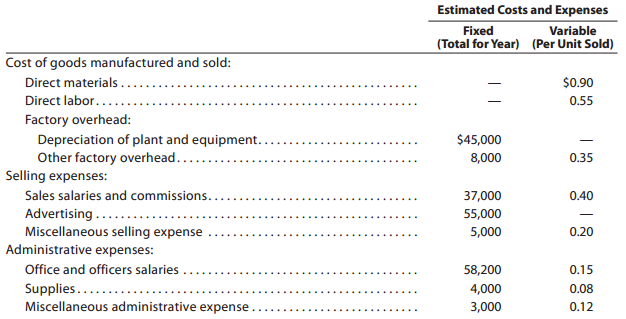

Factory output and sales for 2013 are expected to total 160,000 units of product, which are to be sold at $4.50 per unit. The quantities and costs of the inventories at December 31, 2013, are expected to remain unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows:

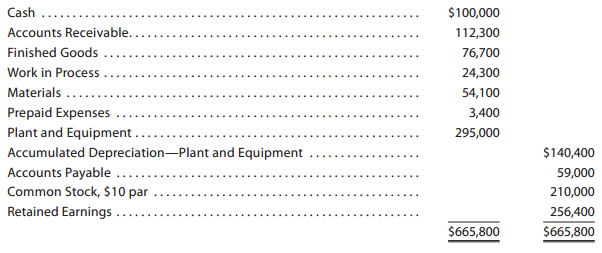

Balances of accounts receivable, prepaid expenses, and accounts payable at the end of the year are not expected to differ significantly from the beginning balances. Federal income tax of $20,000 on 2013 taxable income will be paid during 2013. Regular quarterly cash dividends of $0.10 per share are expected to be declared and paid in March, June, September, and December on 21,000 shares of common stock outstanding. It is anticipated that fixed assets will be purchased for $60,000 cash in May.

1. Prepare a budgeted income statement for 2013.

2. Prepare a budgeted balance sheet as of December 31, 2013, with supporting calculations.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: