Champion Company is considering a contract that would require an expansion of its food processing capabilities. The

Question:

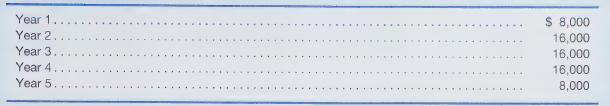

Champion Company is considering a contract that would require an expansion of its food processing capabilities. The contract covers five years. To provide the required products, Champion would have to purchase additional equipment for \($64,000.\) Champion estimates the contract will provide annual net cash inflows (before taxes) of \($26,000.\) For tax purposes, the equipment will be depreciated as follows:

Although salvage value is ignored in the tax depreciation calculations, Champion estimates the equipment will be sold for \($8,000\) after five years.

Required

Assuming a 35% income tax rate and a 10% cutoff rate, compute the net present value of this contract proposal. Using net present value analysis, should Champion accept the contract? (Round amounts to the nearest dollar.

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.