ClassicWindows is a small company that builds specialty wooden windows for local builders. For the year 20X4,

Question:

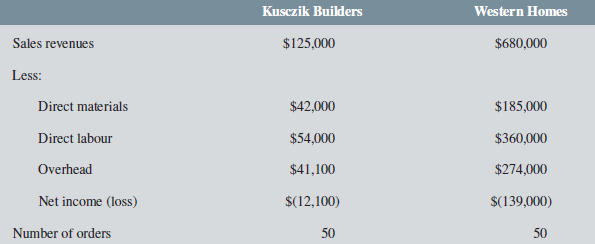

ClassicWindows is a small company that builds specialty wooden windows for local builders. For the year 20X4, Lori Newman prepared the following profitability statement for two of the company?s major customers:

For years, the small company has relied on a simple costing system that allocated all overhead costs using direct labour-hours (DLH). The company paid $18 per hour to its direct labour employees.

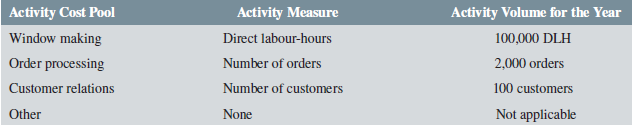

However, the company?s president became interested in activity-based costing (ABC) after reading an article about ABC in a trade journal. An ABC design team was put together, and within a few months a simple system consisting of four activity cost pools had been designed. The activity cost pools and their activity measures appear below:

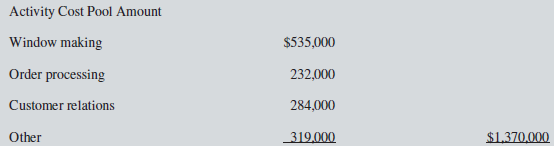

Direct materials and labour costs are easily traceable to individual jobs. The total overhead costs for the year are budgeted to be $1.37 million, as follows:

Overhead:Wages and salaries.......................................$400,000Depreciation....................................................300,000Insurance...........................................................80,000

Rental...............................................................300,000Supplies..............................................................40,000Travel................................................................250,000.......................................$1,370,000

Largely on the basis of interviews with employees, the above overhead costs were assigned to the four activity cost pools as follows:

Required:

1. Compute the profitability of the two customers using the proposed ABC system. Show all the steps in your calculation.

2. Why is there a difference in the profitability of the two customers under the two costing systems? Be specific.

3. What steps (if any) would you take based on the information obtained from the two systems?

4. Katherine Lukey, CEO of ClassicWindows, is wondering whether it is appropriate not to allocate ?other? costs to customers. Analyze the costs of the ?other? category and advise Lukey what she should do. If you advise her that these costs should be allocated to individual customers, identify the allocation base(s) you would use.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan