Companies typically base their predetermined overhead rates on the estimated, or budgeted, amount of the allocation base

Question:

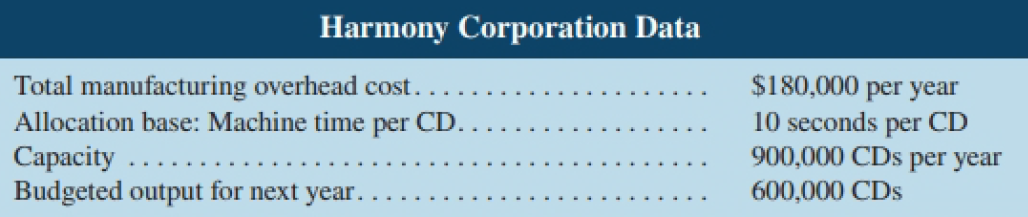

Companies typically base their predetermined overhead rates on the estimated, or budgeted, amount of the allocation base for the upcoming period. This is the method that is used in the chapter, but it is a practice that has recently come under severe criticism. An example will be very helpful in understanding why. Harmony Corporation manufactures music CDs for local recording studios. The company has a CD-duplicating machine that can produce a new CD every JO seconds from a master CD. The company leases the CD-duplicating machine for $180,000 per year, and this is the company's only manufacturing overhead. With allowances for setups and maintenance, the machine is theoretically capable of producing up to 900,000 CDs per year. However, due to weak retail sales of CDs, the company's commercial customers are unlikely to order more than 600,000 CDs next year. The company uses machine time as the allocation base for applying manufacturing overhead. These data are summarized below:

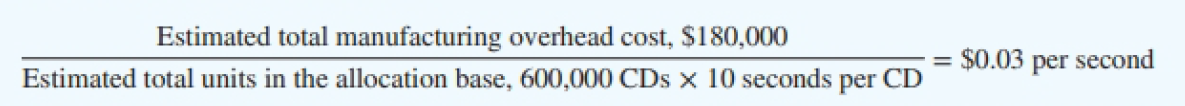

If Harmony follows common practice and computes its predetermined overhead rate using estimated, or budgeted, figures, then its predetermined overhead rate for next year will be $0.03 per second of machine time, computed as follows:

Since each CD requires IO seconds of machine time, each CD will be charged $0.30 of overhead cost.

Critics charge that there are two problems with this procedure. First, if predetermined overhead rates are based on budgeted activity, then the unit product costs will fluctuate, depending on the budgeted level of activity for the period. For example, if the budgeted output for the year was only 300,000 CDs, the predetermined overhead rate would be $0.06 per second o f machine time or $0.60 per CD rather than $0.30 per CD. In general, if budgeted output falls, the overhead cost per unit will increase; it will appear that the CDs cost more to make. Managers may then be tempted to increase prices at the worst possible time- just as demand is falling.

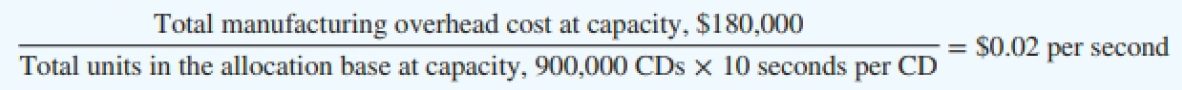

Second, critics charge that under the traditional approach, products are charged for resources that they do not use. When the fixed costs of capacity are spread over estimated activity, the units produced must shoulder the costs of unused capacity. That is why the applied overhead cost per unit increases as the level of activity falls. The critics argue that products should be charged only for the capacity that they use; they should not be charged for the capacity they do not use. This can be accomplished by basing the predetermined overhead rate on capacity as follows:

Since the predetermined overhead rate is $0.02 per second, the overhead cost applied to each CD will be $0.20. This charge is constant and is not affected by the level of activity during a period. If output falls,the charge will still be $0.20 per CD.

The use of capacity will almost certainly result in under applied overhead. If actual output at Harmony Corporation is 600,000 CDs, then only $120,000 of overhead cost will be applied to products ($0.20 per CD × 600,000 CDs). Since the actual overhead cost is $180,000, there will be under applied overhead of $60,000. In another departure from tradition, the critics suggest that the under applied overhead that results from idle capacity should be separately disclosed on the income statement as the Cost of Unused Capacity-a period expense. Disclosing this cost as a lump sum on the income statement, rather than burying it in Cost o f Goods Sold or ending inventories, makes it much more visible to managers.

Official pronouncements (IAS 2) now prohibit basing predetermined overhead rates on capacity for external reports, although predetermined overhead rates based on capacity could be used for internal reporting. If so, managers would need to judge the benefits in terms of improved decision making against the potential cost of having to calculate inventory values and the Cost of Goods Sold using one method for external reporting and a different method for internal reporting.

Required

If the plant is operated at Jess than capacity and the predetermined overhead rate is based on the estimated total units in the allocation base at capacity, will overhead ordinarily be over applied or under applied?

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby