Double Duty, a combination fertilizer-weed killer, is Alanco's only product. It is sold nationwide through normal marketing

Question:

Double Duty, a combination fertilizer-weed killer, is Alanco's only product. It is sold nationwide through normal marketing channels to retail nurseries and garden stores.

Taylor Nursery plans to sell a similar fertilizer-weed killer compound through its regional nursery chain under its own private label. Taylor does not have manufacturing facilities of its own, so it has asked Alanco (and several other companies) to submit a bid for manufacturing and delivering a 25,000-kilogram order of the private-brand compound to Taylor. While the chemical composition of the Taylor compound differs from that of Double Duty, the manufacturing processes are very similar.

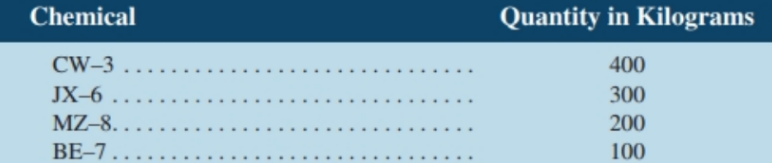

The Taylor compound would be produced in 1,000-kilogram lots. Each lot would require 30 direct labour-hours and the following chemicals:

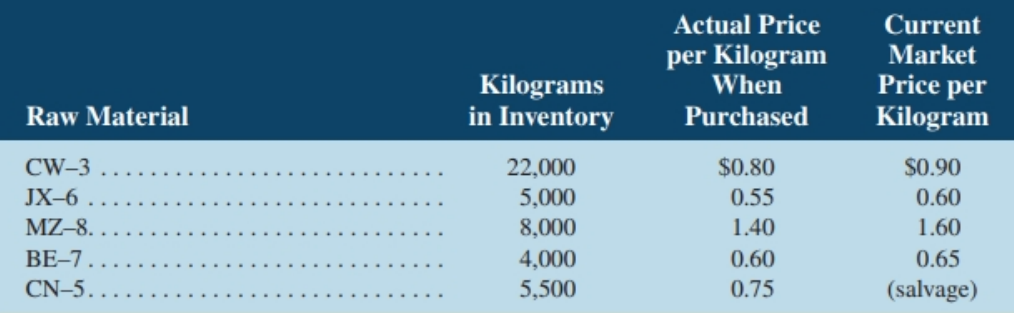

The first three chemicals (CW-3, JX-6, and MZ-8) are all used in the production of Double Duty.

BE-7 was used in another compound that Alanco discontinued several months ago. The supply of BE-7 that Alanco had on hand when the other compound was discontinued was not discarded. Alanco could sell its supply of BE-7 at the prevailing market price Jess $0.10 per kilogram selling and handling expenses.

Alanco also has on hand a chemical called CN-5, which was manufactured for use in another product that is no longer produced. CN-5, which cannot be used in Double Duty, can be substituted for CW-3 on a one-to-one basis without affecting the quality of the Taylor compound. The CN-5 in inventory has a salvage value of $500.

Inventory and cost data for the chemicals that can be used to produce the Taylor compound are as shown below

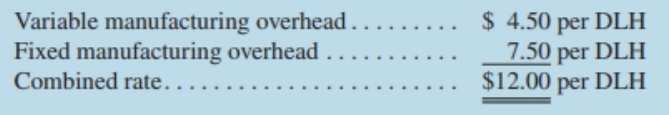

The current direct labour rate is $14 per hour. The predetermined overhead rate is based on direct labour-hours (DLH). The predetermined overhead rate for the current year, based on a two-shift capacity of 400,000 total DLH with no overtime, is as follows:

Alanco's production manager reports that the current equipment and facilities are adequate to manufacture the Taylor compound. Therefore, the order would have no effect on total fixed manufacturing overhead costs. However, Alanco is within 400 hours of its two-shift capacity this month. Any additional hours beyond 400 hours must be done in overtime. If need be, the Taylor compound could be produced on regular time by shifting a portion of Double Duty production to overtime. Alanco's rate for overtime hours is 11/2 times the regular pay rate, or $21 per hour. There is no allowance for any overtime premium in the predetermined overhead rate.

Required:

1. Alanco has decided to submit a bid for a 25,000 kilogram order of Taylor Nursery's new com-pound. The order must be delivered by die end of the current month. Taylor Nursery has indicated that this is a one-time order that will not be repeated. Calculate the lowest price that Alanco could bid for the order without reducing its operating income.

2. Refer to the original data. Assume that Taylor Nursery plans to place regular orders for 25,000-kilogram lots of the new compound during the coming year. Alanco expects the demand for Double Duty to remain strong. Therefore, the recurring orders from Taylor Nursery would put Alanco over its two-shift capacity. However, production could be scheduled so that 60% of each Taylor Nursery order could be completed during regular hours. As another option, some Double Duty production could be shifted temporarily to overtime so that the Taylor Nursery orders could be produced on regular time. Current market prices are the best available estimates of future market prices.

Alanco's standard markup policy for new products is 40% of the full manufacturing cost, including fixed manufacturing overhead. Calculate the price that Alanco would quote Taylor Nursery for each 25,000-kilogram Jot of the new compound, assuming that it is to be treated as a new product and this pricing policy is followed.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby