Downeyville Products, Inc., is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided as follows.

€¢ One plantwide rate. The predetermined overhead rate is $140 per direct labor hour.

€¢ Department rates. The Cutting department uses a rate of 200 percent of direct labor cost, and the Finishing department uses a rate of $50 per machine hour.

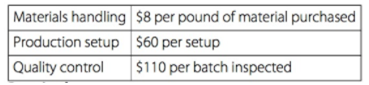

€¢ Activity-based costing rates. Three activities were identified, and rates were calculated for each activity.

Required:

a. Direct labor hours totaled 2,000 for the year. Using the plantwide method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

b. During the year, the Cutting department incurred $80,000 in direct labor costs, and the Finishing department used 1,800 machine hours. Using the department method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

c. During the year, 6,000 pounds of material were purchased, 1,600 production setups were performed, and 1,300 batches of products were inspected. Using the activity-based costing approach, calculate the amount of overhead applied to products, and make the appropriate journal entry.

d. Downeyville Products, Inc., closes overapplied or underapplied overhead to the cost of goods sold account at the end of each year. Prepare the journal entry to close the manufacturing overhead account at the end of the year for each of the following independent scenarios assuming the company made the journal entry to apply overhead in requirement c.

1. The company recorded $302,500 in actual overhead costs for the year.

2. The company recorded $243,000 in actual overhead costs for the year.

Materials handling $8 per pound of material purchased Production setup $60 per setup $110 per batch inspected Quality control

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

For all three methods the amount of overhead to be applied is calculated as Predetermined overhead rate x actual activity in allocation base a Using o... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 2 attachments)

1592_6062c74ccfbe0_641395.pdf

180 KBs PDF File

1592_6062c74ccfbe0_641395.docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards