Estate Pension Services helps clients set up and administer pension plans that comply with tax Jaws and

Question:

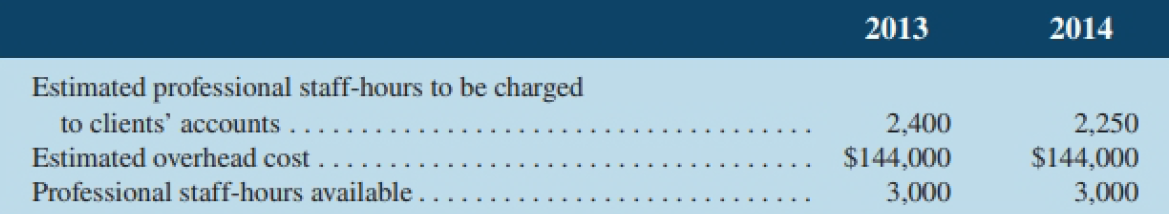

Estate Pension Services helps clients set up and administer pension plans that comply with tax Jaws and regulatory requirements. The firm uses a job-order costing system in which overhead is applied to clients' accounts on the basis of professional staff-hours charged to the accounts. Data concerning two previous years appear below:

"Professional staff-hours available" is a measure of the capacity of the firm. Any hours available that are not charged to clients' accounts represent unused capacity.

Required:

1. Jennifer Miyami is an established client whose pension plan was set up many years ago. In both 2013 and 2014, only five hours of professional staff time were charged to Miyami's account. If the company bases its predetermined overhead rate on the estimated overhead cost and the estimated professional staff-hours to be charged to clients, how much overhead cost would have been applied to Miyami's account in 2013? In 2014?

2. Suppose that the company bases its predetermined overhead rate on the estimated overhead cost and the estimated professional staff-hours to be charged to clients as in (I) above. Also suppose that the actual professional staff-hours charged to clients' accounts and the actual overhead costs turn out to be exactly as estimated in both years. By how much would the overhead be under applied or over applied in 2013? In 2014?

3. Refer back to the data concerning Miyami in (I) above. If the company bases its predetermined overhead rate on the estimated overhead cost and the professional staff-hours available, how much overhead cost would have been applied to Miyami's account in 2013? In 2014?

4. Suppose that the company bases its predetermined overhead rate on the estimated overhead cost and the professional staff-hours available as in (3) above. Also suppose that the actual professional staff. hours charged to client accounts and the actual overhead costs turn out to be exactly as estimated in both years. By how much would the overhead be under applied or over applied in 2013? In 2014?

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby