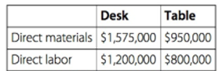

Fine Finishing, Inc., produces a wood desk that sells for $500 and a wood table that sells

Question:

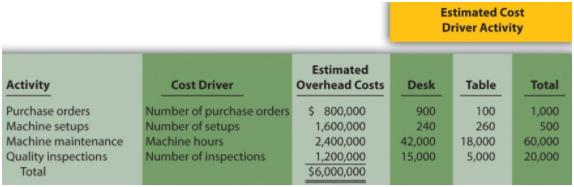

The management of Fine Finishing, Inc., would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

a. Calculate the direct materials cost per unit and direct labor cost per unit for each product.

b. 1. Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit allocated to the desk and table products.

2. Using the plantwide allocation method, calculate the product cost per unit for the desk and table products. Round results to the nearest cent.

c. 1. Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity.

2. Using the activity-based costing allocation method, allocate overhead to each product.

3. What is the product cost per unit for the desk and table products?

d. Calculate the per unit profit for each product using the plantwide approach and the activity- based costing approach. How much did the per unit profit change when moving from one approach to the other?

e. Refer to the estimated cost driver activity provided. Calculate the percent of each activity consumed by each product (e.g., the desk product issued 900 of the 1,000 purchase orders issued in total and therefore consumes 90 percent of this activity). These percentages represent the amount of overhead costs allocated to each product using activity-based costing. Using the plantwide approach, 60 percent of all overhead costs are allocated to the desk and 40 percent to the table. Compare the activity-based costing percentages to the percentage of overhead allocated to each product using the plantwide approach. Use this information to explain what caused the shift in overhead costs to the desk product using activity-based costing.

Step by Step Answer: