For each of the following independent situations, compute the net after-tax cash flow amount by subtracting cash

Question:

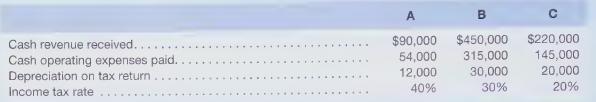

For each of the following independent situations, compute the net after-tax cash flow amount by subtracting cash outlays for operating expenses and income taxes from cash revenue. The cash outlay for income taxes is determined by applying the income tax rate to the cash revenue received less the cash and noncash (depreciation) expenses.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.

Question Posted: