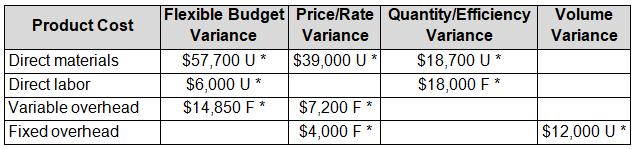

Holtje sells hammocks to many different retail outlets, and has gathered the following information for the period:

Question:

Holtje sells hammocks to many different retail outlets, and has gathered the following information for the period:

* U = unfavorable, F = favorable.

Additional information:

● Planned production was 3,000 units, but only 2,700 units were produced.

● Direct materials: 130,000 feet of materials were purchased at $2.50 per foot, for a total cost of $325,000. The company uses a just-in-time system, so it used all 130,000 feet purchased.

● Direct labor: The standard time per unit was 5 hours at $12 per hour. The total actual payroll was $168,000.

● Variable overhead: The flexible budget was based on 5 standard direct labor hours at $5 per hour.

● Fixed overhead: Actual cost was $116,000.

Solve for the missing information. The direct materials information is shown as an example.

Solution to part a provided as example for requirements c through i:

Direct material price variance = (AP – SP)AQ purchased

$39,000 U = ($2.50 – SP)130,000

$0.30 U = $2.50 – SP

SP = $2.20

For standard rate = $39,000 ÷ 130,000 = difference between actual and standard rate = $0.30. Since the variance is unfavorable, the actual rate of $2.50 is $0.30 higher than the standard of $2.20.

Direct materials quantity variance = (AQ used – SQ)SP

$18,700 F = (130,000 – SQ)$2.20

8,500 F = 130,000 – SQ

SQ = 138,500

For standard feet per flexible budget = $18,700 ÷ $2.20 = difference between actual and standard quantity of feet = 8,500 feet. The variance is favorable, so the standard feet allowed for the units produced in the flexible budget was 8,500 more than the 138,000 feet used = 138,500.

a. Given the purchase price variance, what was the standard rate per foot of materials, and how many feet of material were allowed per the flexible budget?

b. What was the direct labor rate variance?

c. How many standard direct labor hours were allowed per the flexible budget for actual production?

d. Given the direct labor efficiency, how many actual hours were worked?

e. What was the actual direct labor rate per hour?

f. How much was the fixed overhead budget amount?

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope